Real Estate can be a challenging sector for value investors, in part because valuations for this group, on a cash-flow basis, tend to be higher than other areas of the market. At the same time, Real Estate Investment Trusts (REITS), the largest component of the sector, have been lagging the broader market since 2022, owing to higher interest rates, a potential oversupply of apartments, and work-from-home policies weighing on office building valuations.

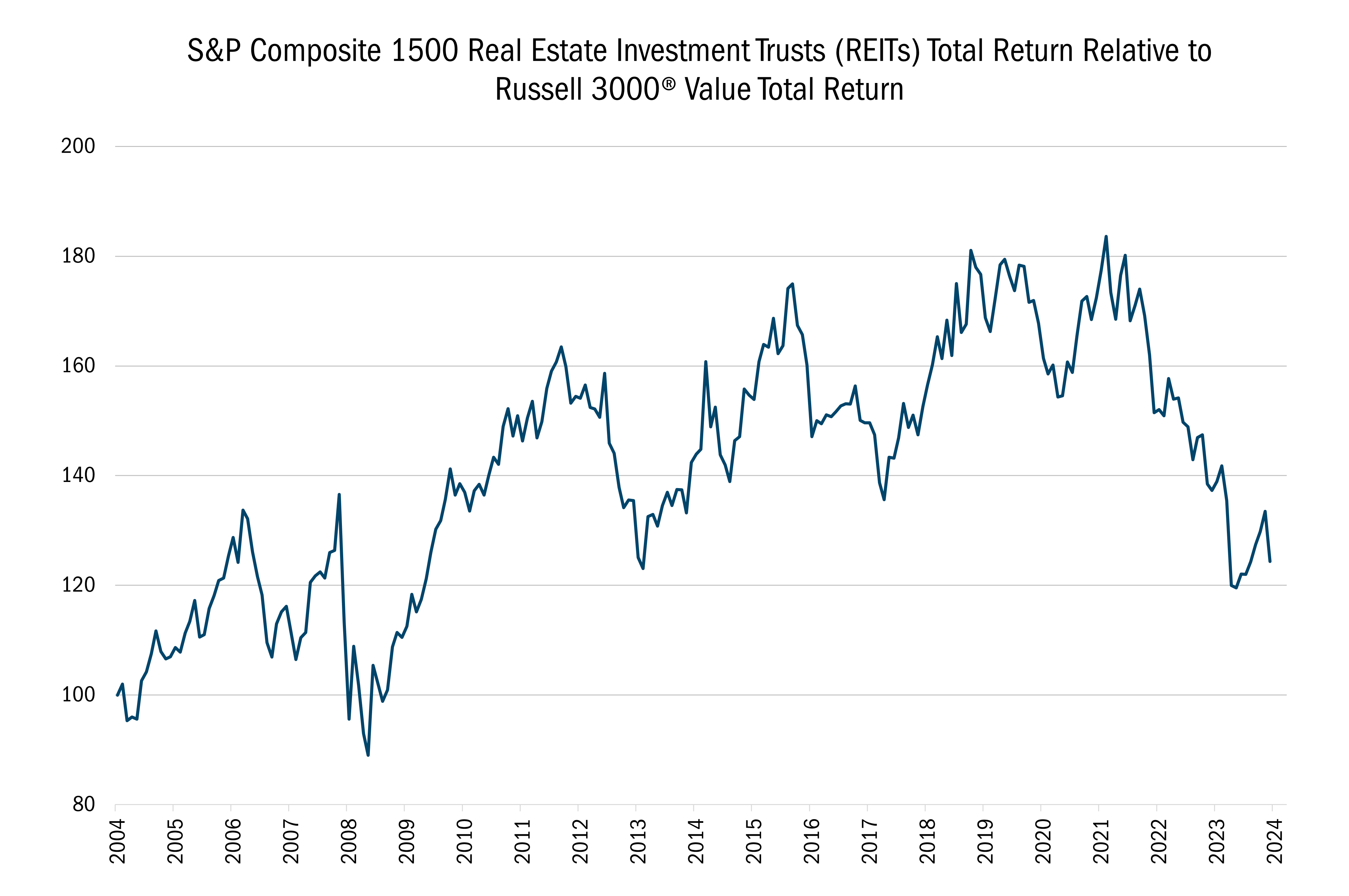

While the chart below highlights these recent struggles, we also think it depicts why it makes sense to have exposure to Real Estate in our portfolios. The chart illustrates the performance of REITs relative to value stocks since the end of 2004. When the line is falling, as has been the case since 2022, REITs trailed the broad market. But when the line is climbing, that signals periods when REITs have outperformed. As the chart indicates, over the last 20 years, there have been at least five multi-year rallies in this group.

Predicting the future is impossible, and these headwinds may persist. However, the fact that REITs have underperformed for such a long stretch may indicate the trend will eventually reverse — for long-term investors who are patient. We don’t believe it makes sense to be underweight a sector that makes up 10% of the Russell 2000 Value Index, especially when we can find undervalued Real Estate stocks that fit our 10 Principles of Value Investing™.

Source: FactSet Research Systems, Inc., Monthly data 11/30/2004 to 10/31/2024. The data in this chart represents the S&P Composite REITS Total Return in relation to the Russell 3000 Value Total Return. All indices are unmanaged. It is not possible to invest in an index. Past performance does not guarantee future results.

©2025 Heartland Advisors | 790 N. Water Street, Suite 1200, Milwaukee, WI 53202 | Business Office: 414-347-7777 | Financial Professionals: 888-505-5180 | Individual Investors: 800-432-7856

Past performance does not guarantee future results.

Investing involves risk, including the potential loss of principal.

There is no guarantee that a particular investment strategy will be successful.

The statements and opinions expressed in the articles or appearances are those of the presenter. Any discussion of investments and investment strategies represents the presenters' views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. Any forecasts may not prove to be true.

Economic predictions are based on estimates and are subject to change.

Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

Heartland’s investing glossary provides definitions for several terms used on this page.

Sector and Industry classifications are sourced from GICS®. The Global Industry Classification Standard (GICS®) is the exclusive intellectual property of MSCI Inc. (“MSCI”) and S&P Global Market Intelligence (“S&P”). Neither MSCI, S&P, their affiliates, nor any of their third party providers (“GICS Parties”) makes any representations or warranties, express or implied, with respect to GICS or the results to be obtained by the use thereof, and expressly disclaim all warranties, including warranties of accuracy, completeness, merchantability and fitness for a particular purpose. The GICS Parties shall not have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of such damages.

ALPS Distributors, Inc., is not affiliated with Heartland Advisors.