At Heartland, our portfolio managers are willing to take on some ‘income statement risk’ as long as it is not amplified by ‘leverage risk.’ In other words, we will consider companies whose earnings might be down or have gone negative — provided those businesses don’t have elevated levels of debt. Our 10 Principles of Value Investing™ describes our preference for limited long-term debt as “low-debt companies have more flexibility during adverse business conditions because they can direct cash to operations rather than interest expenses.”

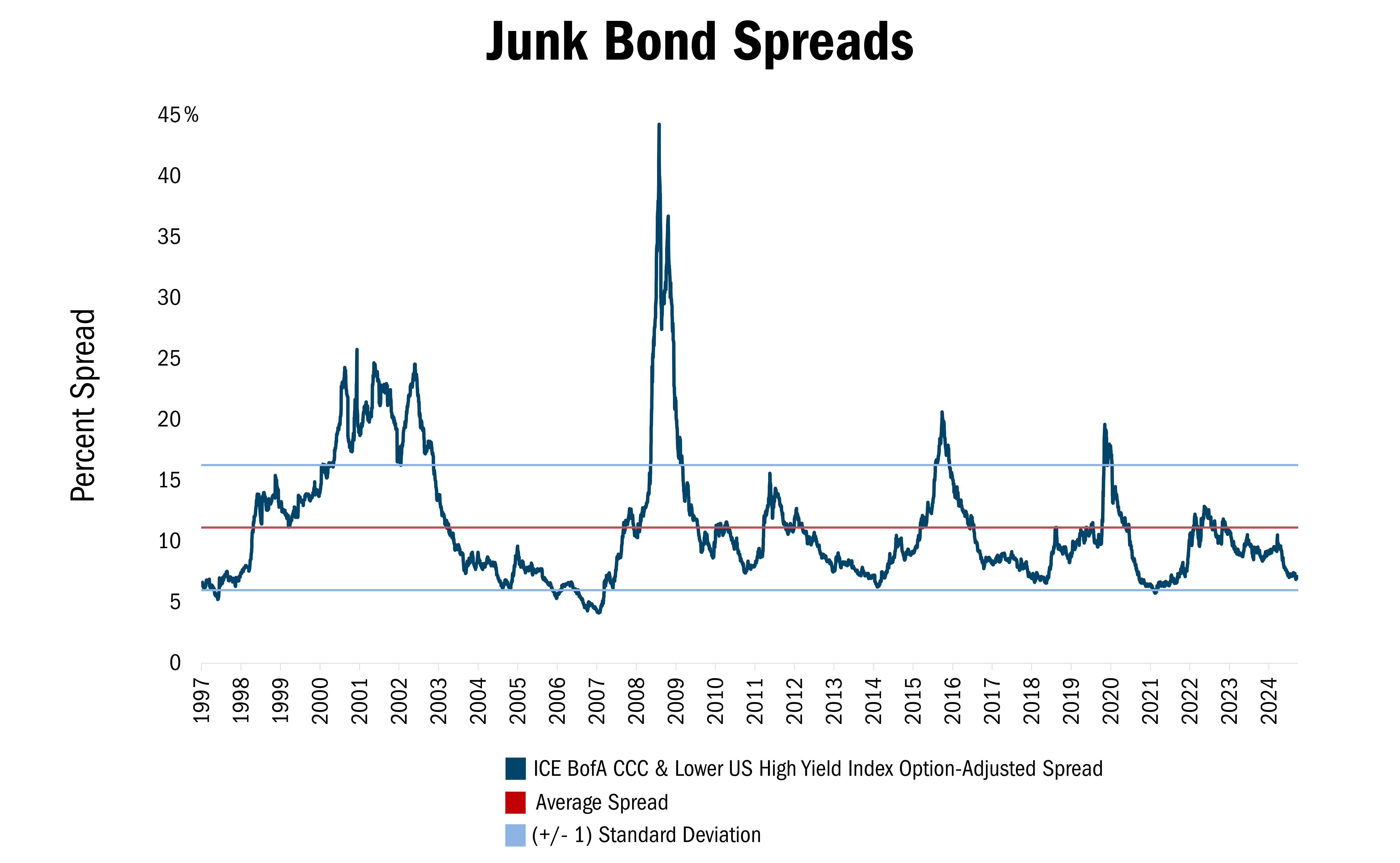

Now, you might not think that investors are worried about ‘adverse conditions’ on the horizon, given how the bond market has been behaving lately. As you can see in the chart below, the riskiest bonds — debt rated CCC or lower — are paying just 7 percentage points more than Treasuries of similar maturities. That’s near where spreads stood in late 2007, just before the start of the global financial crisis.

Source: ICE Data Indices, LLC, Monthly data 5/19/1997 to 02/07/2025. This data represents the Option-Adjusted Spread (OAS) of the ICE BofA US Corporate C Index, a subset of the ICE BofA US High Yield Master II Index tracking the performance of US dollar denominated below investment grade rated corporate debt publicly issued in the US domestic market. This subset includes all securities with a given investment grade rating CCC or below. The ICE BofA OASs are the calculated spreads between a computed OAS index of all bonds in a given rating category and a spot Treasury curve. An OAS index is constructed using each constituent bond's OAS, weighted by market capitalization. All indices are unmanaged. It is not possible to invest in an index. Past performance does not guarantee future results.

Historically, when investors are fearful of an economic downturn or market volatility ahead, they demand significantly higher yields than Treasuries are paying as compensation for the default risk they’re assuming. Today’s compressed spreads would seemingly point to investor confidence. Yet credit spreads can also be a gauge of investor complacency. In our view, with low spreads taking place against a backdrop of stickier-than-expected inflation and uncertainties surrounding a potential trade war abroad and unpredictable federal spending cuts, it makes sense for investors to be paying close attention to financial soundness.

To be clear, we are not making a call on whether bond investors are right or wrong. As equity investors, however, we cannot ignore the fact that credit spreads are showing levels of complacency that cropped up in the late 1990s, ahead of the bursting of the dotcom bubble; in 2007, ahead of the global financial crisis; and in 2019, ahead of the global pandemic. We are not predicting a similar calamity, but history shows that it pays to be mindful of financial soundness in periods such as this.

In fact, at Heartland, we believe it is important to focus on the financial health and balance sheet strength of any company we are exploring, which is why financial soundness is a critical component of our 10 Principles of Value Investing™.