Football debates are heating up in Wisconsin as Green Bay prepares to host the 2025 NFL draft. General Manager of The Green Bay Packers, Brian Gutekunst, will face the age-old question of “Fill a need or take the best available?” Should he simply take the very best talent on the board? Or should he examine the existing roster carefully and take the best player available in the largest position of need, even if that player may not be as talented as other options? The theories collide as an argument can be made that you can’t have “too much talent”, but it is also fair to say you cannot win with a roster of 53 quarterbacks.

At Heartland, we face a similar conundrum when constructing a portfolio. Should we always look to add the most attractively valued opportunity with the biggest upside? Or should we reflect on the composition of the portfolio and look for new names that will mitigate overall, unwanted risk? So, the same story, can you ever have “too many, high-conviction stocks?,” and can you provide solid, risk adjusted returns with an entire portfolio of energy companies?

In our opinion, and it seems, the opinion of the GM of our beloved Packers, it takes a delicate combination of roster building (portfolio construction) and player selection (stock picking).

Building a championship roster includes identifying the missing pieces critical to success. In the NFL, it’s tough to win with your quarterback flat on his back, so offensive linemen are always at a premium. Knocking a quarterback on his back is also valuable, so pass rushers are often selected early in the draft. But what if your team simply cannot stop the run in critical moments; allowing the opponent to squeeze the clock and not give your offense a chance to score? Then you may need to prioritize an interior defender like a defensive tackle or inside linebacker, earlier than you otherwise might.

For us, construction is about mitigating unintended risks. We use a combination of rules and tools to help prevent those risks from impacting the portfolio, as well as to guide where in the market we should be looking for new ideas. If the data from our analytical tools tells us the largest undesired risk in the portfolio is due to under exposure to the Industrials sector, we will generally roll up our sleeves and get to work analyzing that area of the market even if we do not see them as the greatest opportunity on an absolute basis.

To analyze players, we believe it takes a disciplined, repeatable process that has quantifiable metrics to provide a margin of safety and qualitative measures to determine how much upside potential may exist.

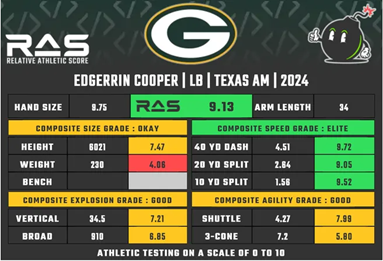

The common metrics in the NFL have come by way of a Relative Athletic Score or “RAS”. This measures a player’s height, weight, speed, strength, agility and explosiveness. The players’ combined score is compared to players at the same position, for relative comparison. The idea is, all else equal, can you find bigger, stronger, faster players to set a minimum standard.

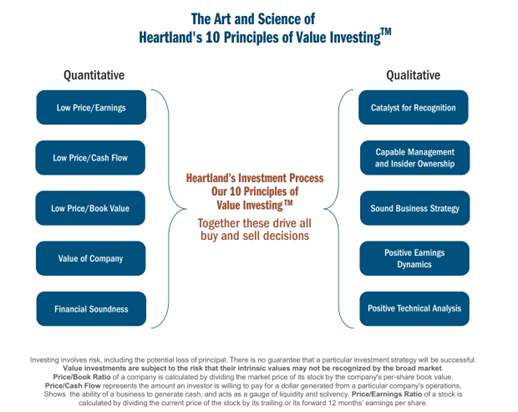

At Heartland, we use our 10 Principles of Value Investing™ in a similar fashion. Our 5 quantitative measures, price to earnings, price to book, price to cashflow, valuation of the business and financial soundness, help determine, all else equal, if we have an attractively priced stock with a solid balance sheet. This helps build our potential margin of safety.

Then the qualitative work begins. In the NFL, it’s film study, player interviews, conversations with their coaches, learning about their background, the system that may fit their skill set best, etc.

For us, we want to meet the management team, understand their business strategy, look for a plan they will deploy to unlock shareholder value, and evaluate their conviction by analyzing insider stock purchases.

After combining the overall needs and specific opportunity analysis, it’s time to make decisions.

Heading into last season, the Green Bay Packers were coming off two years of the rush defense finishing in the bottom quartile of the league.

The decision was made to reorganize the defense under the new defensive coordinator, Jeff Hafley. Going from a 3-4 to a 4-3 configuration would require the addition of an inside linebacker who could be more of a disruptive playmaker than 2022 1st round draft pick, Quay Walker, had been.

The 2024 draft was packed full of wide receiver (WR) talent. If you wanted a starter, regardless of position, WRs would likely provide opportunity well into the second round. Inside linebackers, on the other hand, showed a lack of depth at a position many franchises consider not consequential enough to justify an early pick.

A perfect setup to find balance between a need and the available talent.

The Packers got to work and zeroed in on a player with the quantitative measures needed to convince them that the athletic floor was set. In addition to the qualitative factors, game film (describing him as a “ball magnet”), statistical production and high-level of competition while at Texas A&M University, helped the Packers believe there was upside. So, with the 45th overall pick (9 WRs were off the board by the 34th selection) the Packers picked the first inside linebacker taken in the 2024 draft, Edgerrin Cooper.

Source: RAS. March 7, 2025.

From the RAS data, Cooper is not flawless quantitatively. The question is, how do the flaws impact him as a player and what the Packers need? He is lighter than similar players (230 lbs.), presenting a potential problem getting off blocks and tackling powerful running backs or tight ends. Watching the film helped The Packers determine how much of a concern this should be. The tape showed an explosive playmaker willing to use his body to be very physical. Can he easily shed an all-pro pulling guard? Probably not, but neither can most inside linebackers. He can get in the backfield in a hurry to make tackles behind the line of scrimmage and can run like a deer in coverage. Those are trade-offs the Packers were willing to make in a quest for more big plays.

Flash forward to the end of the season and even though he missed some time because of an injury, Cooper was named to the First Team All-Rookie Defense, 2x NFL Defensive Player of the Month and the highest rated defensive player in the league regardless of position per Pro Football Focus for weeks 15-18.

The Packers run defense went from 28th in 2023 to 7th in 2024. Turnovers forced went from 18 to 31. The Packers also added other talents, namely All-Pro Safety, Xavier McKinney, but Cooper was an important factor in the defensive jump.

So, they created a magical combination of need and player converging to the benefit of the team.

The NFL is not the only place where there can be an inherent bias against a particular subset (like inside linebackers). In the land of value investors, it is very common for active managers to have an overall disinterest in Real Estate Investment Trusts (REIT). The refrain is often that “they don’t fit our process.”

To accomplish our goal of producing consistent alpha generation, primarily through stock selection, in early 2024, we needed a REIT. We rolled up our sleeves and dug in on the “inside linebackers” of our benchmark.

After working through the quantitative component of the 10 Principles of Value Investing™, we narrowed our focus down to Camden Property Trust (CPT). While it looked expensive on a price to book basis, we were not deterred. It’s common for REITs to trade rich on this measure due to the process utilized to report assets on their books. CPT has a solid history of outperformance versus comparable REITs combined with one of the strongest balance sheets in the industry.

The stock was trading at a discount to historic averages due to what we felt was a short-term earnings headwind from a high level of new supply in the market. We were confident the oversupply of inventory would be worked through as CPT held property in migrating States, such as Texas, Florida and Georgia.

Flash forward, and the stock has been a relative outperformer and contributed to the smoothing of factor and sector risk in the portfolio.

With the draft upon us, the real question is whether to focus on need or best available? To build a winning team or a consistent portfolio, in our opinion, it’s a balance of both.