First Quarter Market Discussion

What a difference a quarter makes. The mood of the market took a 180-degree turn from the end of last year, amid rising uncertainties surrounding federal policy. As fears over tariffs, spending cuts, and the cancellation of government contracts softened business and consumer confidence, volatility returned while investors braced for an economic slowdown.

The Russell Midcap® Index slumped 3.4% in the first quarter and the S&P 500 Index was down 4.3%. Value stocks outperformed growth in this environment, as rising concerns about the long-term returns on capital of artificial intelligence-related investments weighed on large tech stocks.

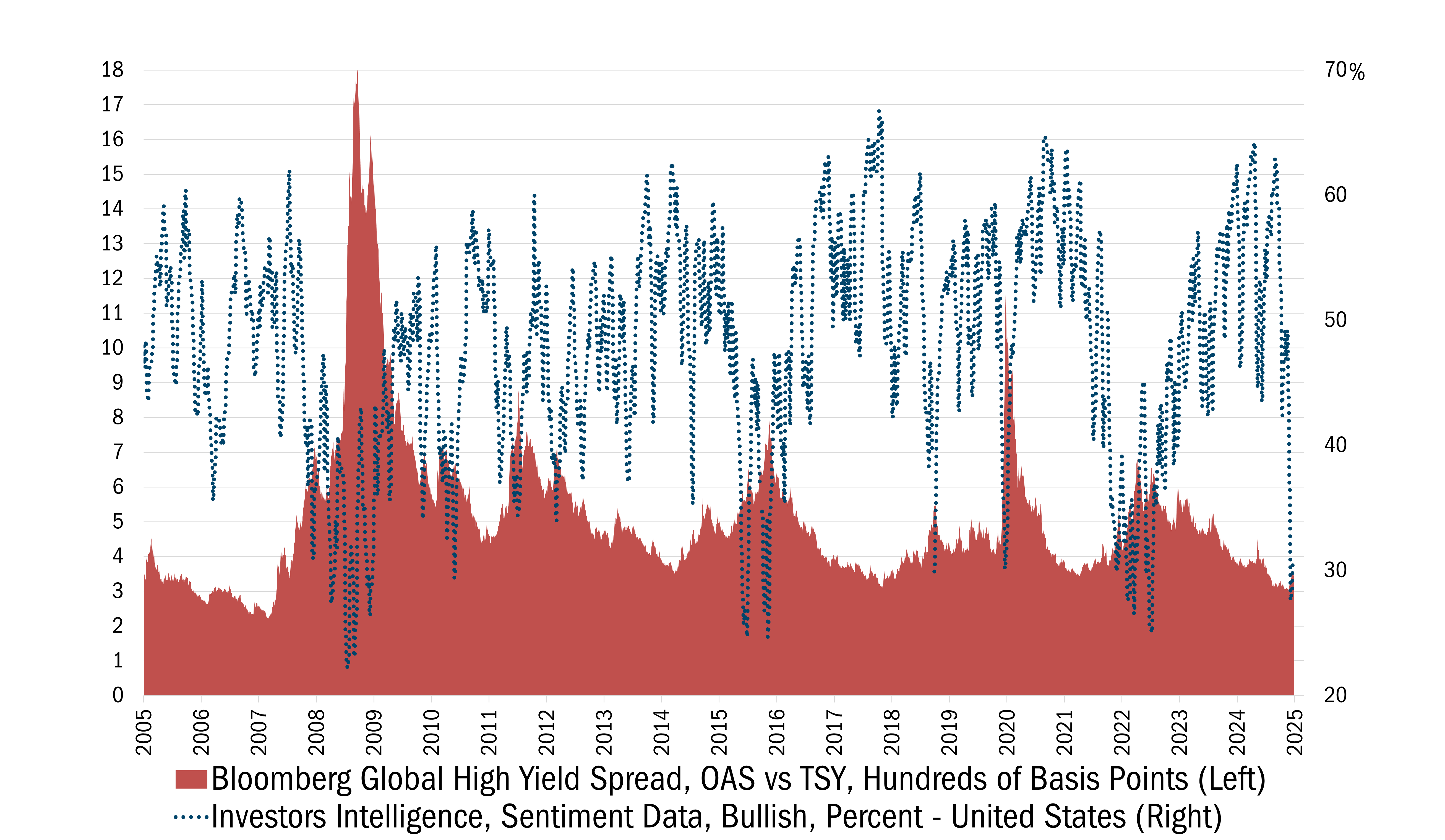

Though heightened volatility often strikes fear in the minds of market participants, we believe more businesses are being priced for a meaningful economic slowdown, if not a recession. We are finding opportunities to increase our exposure to parts of the market that have fallen victim to the shifting narrative. While high yield credit spreads have only begun to widen off a cyclical low, the Investors Intelligence Sentiment Index experienced a sharp drop in the percentage of investors who are bullish on the equity market, a decline on par with the COVID-19 shutdowns, the global financial crisis, and the bursting of the dotcom bubble (see the chart below).

Source: Bloomberg. Daily data 3/30/2005 to 3/28/2025. This chart represents the recession periods comparing the Bloomberg Global High Yield and the Investors Intelligence Sentiment Data Percentage. The Bloomberg Global High Yield Index is a multi-currency flagship measure of the global high yield debt market. The index represents the union of the US High Yield, the Pan-European High Yield, and Emerging Markets (EM) Hard Currency High Yield Indices. The Investors Intelligence Index is a common and widely accepted means of ascertaining the balance of power between the bulls and bears. In actuality, the index may refer to one of several possible sentiment indicators, including an advisor sentiment review and an insider activity review. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

Historically, this degree of pessimism has often been a contrarian indicator that portends positive results for equities in the years to come, provided investors remain patient and avoid yesterday’s winners that, in many cases, still have significant downside potential. For us, that discipline is guided by our 10 Principles of Value Investing™, which directs our attention to attractively priced, well-managed businesses with sound finances and business strategies that can grow intrinsic value throughout market cycles.

Attribution Analysis

The Mid Cap Value portfolio was up 0.67% in the first quarter, outperforming the Russell Midcap® Value Index, which fell 2.11%. Stock selection, which was challenging last year in a more speculative environment, rebounded in the quarter as risk aversion returned and a focus on downside risk was rewarded. Our selection effect was positive in eight sectors, led by Health Care, Financials, Consumer Discretionary, and Information Technology.

In addition to the 10 Principles of Value Investing™, our Strategy is built around another unique process — our two-bucket approach. At all times, we seek to hold both high-quality mid-cap companies trading at bargains (“quality value”) and deeply discounted businesses that have produced poor economic returns over time (“deep value”). We do this because each style within value investing tends to alternate market leadership, just as growth and value strategies generally take turns outperforming.

In the quarter, market volatility negatively impacted both buckets. However, many of our companies held up better than the broad market as they provided better-than-expected updates that belied their modest valuations. Our quality-value holdings rose more than 2% with notably favorable selection in Health Care and Information Technology.

Portfolio Activity

While we are always on the lookout for prospective holdings in each bucket, quality-value businesses, on average, are typically fairly valued. However, in volatile markets like this, opportunities typically present themselves first in quality value. The past quarter was no exception.

Technology. Teledyne Technologies, Inc. (TDY), our largest holding, is the epitome of quality value. TDY has a well-managed, balanced portfolio of sensing and decision-support technologies across commercial and industrial end markets, including multiple secular growth areas spanning advanced machine vision, precision instrumentation, space and unmanned vehicles. TDY’s economically-sensitive customer exposure is somewhat buffered by stable markets like pollution control, water, oceanography and climate monitoring. TDY’s core markets are characterized by high barriers to entry and include niche specialized products and services unlikely to be commoditized.

In a challenging quarter for large tech stocks, Teledyne shares hit an all-time high at the start of the year, after beating consensus earnings estimates and continuing to expand profit margins despite getting little help from its challenged short-cycle end markets (where TDY has some of its highest-margin products). This helped investors imagine what earnings power could be if short-cycle markets recover.

TDY continues to execute on secular growth opportunities while demonstrating that its commercial businesses are more economically resilient than many tech-industrial peers. Despite this strong execution and the stock’s recent performance, the shares still trade at the lower end of the relative valuation premium range TDY has carried over the past decade. As we witness a “reality check” spreading across a number of companies that were trading at what we consider undeserved valuations, we think TDY’s prospects for strong relative performance remain bright.

Industrials. Another opportunity we see in quality value is The Middleby Corporation (MIDD), which designs and manufactures commercial food prep, residential kitchen, and food processing equipment. The company’s commercial foodservice segment, which makes convection ovens, blast chillers, ranges, and fryers, accounts for around 62% of sales, with the remaining 38% equally derived from its food processing and residential business, which operates under high-end brands such as Viking, Masterbuilt, and Rangemaster.

We first purchased shares of MIDD in late 2023 after the company transitioned from trading at a historic premium to industry peers to a discount despite superior profitability. We believe the derating occurred because of prior management’s decision to shift away from being a pure-play commercial equipment supplier and expand into the residential market, which is its lowest-margin and most cyclical business.

Today, management is attempting to boost margins across segments by accelerating brand integration and emphasizing higher margin products that provide enhanced productivity for customers. Until recently, the stock had not responded to these initiatives. In January, regulatory filings disclosed Ed Garden’s activist family office, Garden Investments, had built a position in MIDD. Garden is known in the investment world for co-founding Trian Fund Management alongside famed activist investor Nelson Peltz. The stock rose around 20% on the news. Since the activist news, Middleby has announced the addition of two new board members appointed by Garden, and the company is planning to spin off the food processing segment in 2026. We expect management will eventually spin or sell its low-margin residential segment as well.

Over the past 20 years, MIDD has traded at a median premium of 10% to its industrial peers. At the moment, however, its valuation stands at just 11 times EV/EBITDA over the next 12 months, a nearly 20% discount to the sector.

Healthcare. While persistent economic concerns may provide a growing list of attractive “deep value” options in cyclical companies, Perrigo Co. PLC (PRGO) is an example of heavy lifting on “self-help” bearing fruit in a company that has an economically-resilient demand profile.

The company, which enjoys a 50% share of store-branded, over-the-counter self-care and wellness products in the U.S., has stabilized its sales and pruned its line-up of low-margin items. Management plans to reinvest the healthy cash generated by this part of the business into its higher-margin, faster-growing branded lines in the U.S. and Europe. They also have a clear path, via manufacturing facility consolidation, to drive step-function improvement in the free cash flow margin of its infant formula business from low single digit to mid/high teens.

We believe self-care companies are poised to outperform and experience multiple expansion as the industry benefits from government policy and consumer preference changes. With the evolving political view of healthcare and increased interest from consumers to get and stay healthy, we are seeing a move toward preventive care and healthy aging, driving innovative new products and services such as preventive testing, personalized supplements, and food as medicine. Traditional self-care products should also see a benefit as Health and Human Services Secretary Robert F. Kennedy Jr. focuses on improved access to safe and affordable healthcare options, lowering chronic disease rates, ending childhood chronic disease, prioritizing prevention, and promoting healthy lifestyles and better nutrition.

Despite significantly improving prospects, valuations for self-care companies remain below those of consumer-packaged-goods businesses oriented toward personal care. Within self-care, we believe Perrigo is among the most attractively valued and poised to benefit as the valuation gap closes. We believe PRGO should trade at 11 times 2025 EBITDA or around 14 times earnings, which would put the stock around $40 per share, up from its current price of around $28 a share.

Outlook: Navigating the Cycle with Discipline

At the close of last year, the market was largely fixated on accelerating growth narratives, often with little regard for valuation. Today, the pendulum has swung in the opposite direction, with many companies priced for a material slowing in the business cycle. This dynamic has led to compelling valuations for a growing list of high-quality companies with strong long-term prospects, yet many investors remain hesitant.

As active value managers, our role is to look beyond short-term sentiment and identify businesses with durable competitive advantages trading at attractive prices. While volatility may persist, we remain confident in our disciplined approach, guided by our 10 Principles of Value Investing™ and our commitment to fundamental, bottom-up research. In times of uncertainty, patience and conviction may pave the way for superior long-term returns.

We appreciate your trust and look forward to capitalizing on the opportunities that lie ahead.