Fourth Quarter Market Discussion

Heading into the quarter, investors were hanging tight as inflationary pressures appeared to be moderating, the likelihood of a recession seemed to be diminishing, and the Federal Reserve began its first rate-cutting cycle since the global pandemic. As the election passed, and as a Trump victory started to be priced into the market, investors’ resolve quickly turned to restlessness. The GOP’s clean sweep of the White House, Senate, and House of Representatives only threw fuel on the market’s speculative fire.

The result: Considerations of risk — from geopolitical threats to the growing fiscal debt to valuation concerns — were largely pushed to the back burner as investors focused squarely on upside potential. This sent the broad market surging, with speculative areas of the market benefiting the most. The Russell Midcap® Growth Index soared 8.14% in the quarter while the Russell Midcap® Value Index was down 1.75%.

We find ourselves in an extraordinarily challenging environment, as we are unwilling to chase stocks that we consider speculative or priced with an insufficient margin of safety. This includes companies with historically high multiples on cyclically elevated margins. In our opinion, such opportunities have ample downside risk if any of the prevailing assumptions about this environment don’t materialize.

At the very least, the market seems to be looking beyond current fundamentals and pricing in significant deregulation across industries, relying on faster future economic growth to justify elevated valuations. It’s possible deregulation could come to pass, but there are no guarantees that the incoming administration’s efforts will succeed in accelerating GDP growth to the degree the market now expects. If these efforts fall short or fail to be realized, there are downside risks to consider. For instance, long-term Treasury yields, which act like gravity on valuations, rose meaningfully in response to the pro-growth and protectionist strategy outlined by the incoming administration. The 10-year Treasury yield rose from approximately 3.8% heading into the fourth quarter to approximately 4.5% by year end, and interest rate-sensitive industries like housing are suffering in real time.

In the Financials sector, investors seem to have already priced in deregulation but have yet to do the same when it comes to credit risks facing banks. If deregulatory efforts don’t adequately accelerate earnings growth, there is a potentially significant downside risk for this sector of the benchmark, which climbed 6.3% during the fourth quarter.

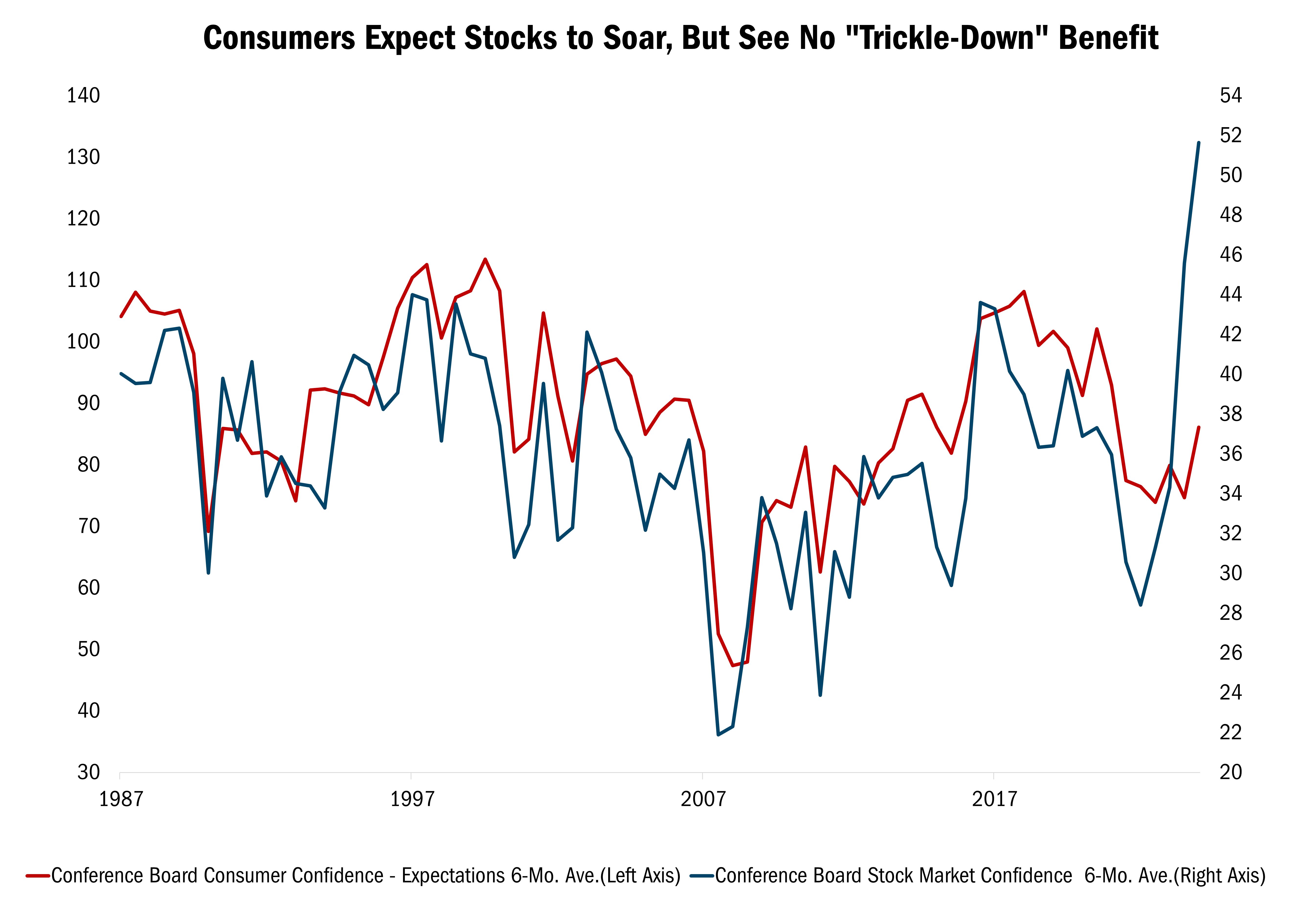

Overall, investor confidence shot up to the highest level in the past quarter century. Historically, confidence that stock prices will rise over the next 12 months has largely mirrored consumer sentiment levels. Lately, however, investor confidence has jumped while consumer expectations for the coming year remain lukewarm (see the chart below).

Source: The Leuthold Group and The Conference Board, semiannual data from 12/31/1987 to 12/31/2024. This chart represents the comparison of the Conference Board Consumer Confidence expectations to the Conference Board Stock Market Confidence. CEO Confidence Survey (Conference Board) is a monthly survey of 100 CEOs from a variety of industries in the U.S. economy. The survey is conducted, analyzed, and reported by the Conference Board, and it seeks to gauge the economic outlook of CEOs, determining their concerns for their businesses, and their view on where the economy is headed. A reading above 50 indicates that the CEOs surveyed are more bullish than bearish on their economic outlook. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

What makes this interesting is that investor confidence and consumer sentiment are contrarian indicators, meaning equity returns are often better when conviction is low. Given how jubilant investor expectations seem to be, it probably makes sense to take a step back and put the market’s mood in perspective.

These dynamics do not seem to be sustainable. That said, we cannot control when the dynamics will change. All we can continue to do is look for compelling opportunities guided by our 10 Principles of Value Investing™, which focus on attractively priced, well-managed businesses that can grow intrinsic value throughout market cycles. Through this process, we continue to establish four price targets for every stock we consider. This gives us a framework for assessing securities under various conditions so that if the downside risks the market is currently overlooking start to materialize, we can act decisively to take advantage of new opportunities.

Attribution Analysis

The Mid Cap Value portfolio was down 5.50% in the fourth quarter, trailing the Russell Midcap® Value Index, which fell 1.75%. Stock selection was positive in just two sectors, Consumer Discretionary, Materials, and Consumer Staples.

Our recent stock-picking hit rate has been below normal. We’ve experienced several outright mistakes in addition to owning a number of businesses with self-help catalysts that we believe are playing out but are failing to “keep up” in the current market environment. We’ve addressed the former and remain patient with the latter. In addition, it may be helpful to explore another unique aspect of our process — the two-bucket approach. At all times, we seek to own both high-quality companies trading at decent bargains (“quality value”) and deeply discounted companies that have produced poor economic returns over time (“deep value”). We do this because these two styles within value investing tend to alternate market leadership, just as growth and value strategies generally take turns outperforming. Dating back to 1985, there is a 50% probability that one category will outperform the other, and vice versa, by at least 600 basis points on a trailing one-year basis.

In the fourth quarter, on a trailing one-year basis, deep value outperformed quality value by 271bps. While there is an estimated 70% probability that divergence would be meaningfully higher using more than 150 quarterly measurements, we’re encouraged to see some performance variation after witnessing the lowest reading in forty years in the third quarter of 2024 at just 10 basis points. Our two-bucket approach typically gives us the upper hand over peers who are overweight in one lagging bucket. But when the two buckets perform similarly, the advantage goes away — which has been the case.

Adding to the challenge, we lagged in both buckets in the fourth quarter. In fact, the drag in the deep value part of our portfolio accounted for most of our underperformance. Roughly two thirds of that was driven by what we owned, and the other one third was based on what we didn’t, such as our lack of exposure to the most speculative areas of the market.

Portfolio Activity

While we are confident in our Strategy and approach, our stock picking in 2024 has not lived up to our standards or the level demonstrated over the last several years. Nevertheless, we believe that we must stay true to our process, which utilizes our 10 Principles of Value Investing™ in concert with our two-bucket approach. The following securities are examples of how we put this process into action:

Consumer Staples. Our 10 Principles of Value Investing™ require us to be patient and wait for a combination of factors to fall into place before committing to a stock. Among them are attractive valuations, sound finances, capable management teams, sound business strategies, catalysts for recognition, and positive earnings dynamics. Sysco Corporation (SYY) is an example of our willingness to wait.

While we purchased shares of the nation’s largest food service distributor in the fourth quarter, we’ve been watching the company’s self-help strategy unfold for years. Recovering from an awful COVID-19-era operating environment, Sysco has been responding with sweeping improvements in its digital capabilities along with changes to sales management and cost containment. Recently, the company — which delivers ingredients and food products to restaurants while avoiding slower-growing grocery stores — has been making a push to grow its specialty platform, offering services such as pre-cut meat, pre-cut produce, and dry aged beef to help customers streamline their operations. When the company’s restaurant, hotel, and food service clients utilize Sysco’s specialty services, they tend to spend three times more than traditional broadline customers.

Management noted that while foot traffic at restaurants was down 3.5% for the industry in the first quarter, Sysco’s sales grew 2.7%, a sign the company’s efforts are working. If that’s the case, the potential opportunity set is sizable. While Sysco is the largest player in this fragmented industry, its market share is only 17%, providing ample room for SYY to keep winning new customers as their clients bounce back and share migrates to the largest players.

Sysco has the largest transactions database in the industry and is now using AI in data analytics to provide unique promotional offers. The company’s sales representatives, for instance, receive real-time alerts and data-driven insights on key factors, such as items that specific customers haven't been buying lately, allowing SYY reps to present customers with unique offers.

Sysco also has a robust capital return program including dividend increases and buybacks. This isn’t surprising given that SYY trades at historically cheap levels. The stock is at 80% of the Enterprise Value/EBITDA multiple of the S&P 1500 Consumer Staples sector.

Financials. Another example of a successful self-help story is Willis Tower Watson (WTW). This insurance brokerage and consulting firm operates two segments: Health, Wealth, and Career (HWC) accounts for 58% of revenues and includes services such as retirement plan administration, health care plan outsourcing, and executive compensation consulting. The other segment, Risk & Broking (R&B), includes global insurance brokerage and risk management consulting services.

In 2020, competitor Aon Plc attempted to acquire WTW in an all-stock merger that would have created the world’s largest insurance brokerage. However, the Justice Department sued to block the merger, which was called off in July 2021. The turmoil from the split caused WTW to significantly underperform its peers on critical metrics including organic revenue, earnings growth, margins, and free cash flow conversion.

In 2022, CEO Carl Hess was brought in to turn the business around. He implemented a restructuring plan to transition the business from a roll-up with disparate systems into a streamlined operating company. Since then, organic growth has accelerated to peer-like performance. We expect WTW’s operating margin and free cash flow, which still trails that of its peers, to narrow driven by the sale of its underperforming Medicare brokers business along with continued operational streamlining efforts.

WTW currently trades at 17.1X consensus 2025 earnings and 13.1X EV/EBITDA, well below its peers, who are trading at a median PE of greater than 23X and 15.4X EV/EBITDA.

Healthcare. One of our worst-performing holdings in the quarter was Centene Corporation (CNC), a giant managed health insurer that provides coverage to 25 million Americans, including 14 million Medicaid enrollees in 30 States. Given our significant exposure to the stock, CNC was the largest drag on performance during the period, but we remain committed to this holding.

The stock suffered a one-two punch this year: First, it underperformed due to an ongoing ‘price vs. cost’ margin squeeze related to high utilization from Medicaid enrollees after a two-year process of redetermining program eligibility. Medicaid is by far the most meaningful segment of Centene’s business. The stock received another blow more recently on negative sentiment after the election on the theory that CNC’s Affordable Care Act health exchange business, which represents the company’s second-largest business line, may not enjoy as much support under a Trump White House and GOP-controlled Congress.

However, the stock performed better after a comprehensive December 12th investor day that provided rebuttals to the negative narrative. Management confidently called a peak in their Medicaid medical loss ratio (MLR), with a 4.5%-5% payment increase from State partners in recent months and further rate increases on the docket throughout 2025.

Regarding the ACA exchange business line, CNC clarified that even in a “worst case” scenario where enrollee tax credits expire at the end of 2025, the earnings risk is no more than $1 per share, compared to $3-$4 per share of earnings recovery potential in its Medicaid and Medicare Advantage product lines. This is noteworthy for a company that trades at 8.5X earnings, has executed numerous operational streamlining initiatives in recent years, and has aggressively repurchased shares at discounted valuations.

We do not expect the ‘worst case’ ACA scenario to transpire. The reality is that ACA exchanges have become a critical outlet to fill coverage gaps for individuals and small business. Some of the strongest growth has come in Republican-stronghold states and rural communities. This has resulted in much stronger bipartisan support for ACA exchanges today compared to Trump’s first term. We found it interesting that a Congressional Budget Office report issued after CNC’s investor day included 76 policy options to reduce the Federal deficit, 14 of them health related, yet none of them contemplated eliminating the exchange tax credits.

At a time when we have observed as much insider selling by corporate executives as we can recall, we also note that several CNC executives and directors are buying shares with their own money, indicating they consider the stock’s valuation to be compelling.

Outlook

While many of our core holdings underperformed during the fourth quarter, we are confident they have the potential to perform better on a relative basis over the next year and beyond, regardless of how the economy unfolds. Temporary overhangs in these holdings have been magnified in a market where risk-aversion has dissipated, and multiple expansion has become extreme. But there are many reasons why these conditions seem to be unsustainable. That is why we believe it will ultimately pay not to chase excessive valuations and speculative behavior and stay true to our 10 Principles of Value Investing™.