Third Quarter Market Discussion

For most of the quarter, the market was fixated on when the Federal Reserve would cut interest rates and by how much. That anticipation helped lift the Russell Midcap® Index up more than 8% from the start of the quarter through Sept. 18, when the central bank lowered rates by half a percentage point. Now that the easing cycle has begun, the knee-jerk ‘risk-on’ reaction seems to have shifted to being risk aware.

Federal Reserve Chairman Jerome Powell made it clear that combatting weakness in the labor market is now a bigger concern for the central bank than fighting inflation. Going forward, this suggests to us that payroll data will be more important to the mood of the markets than monthly updates of inflation indicators like Consumer Price Index. On the jobs front, the news may not be great.

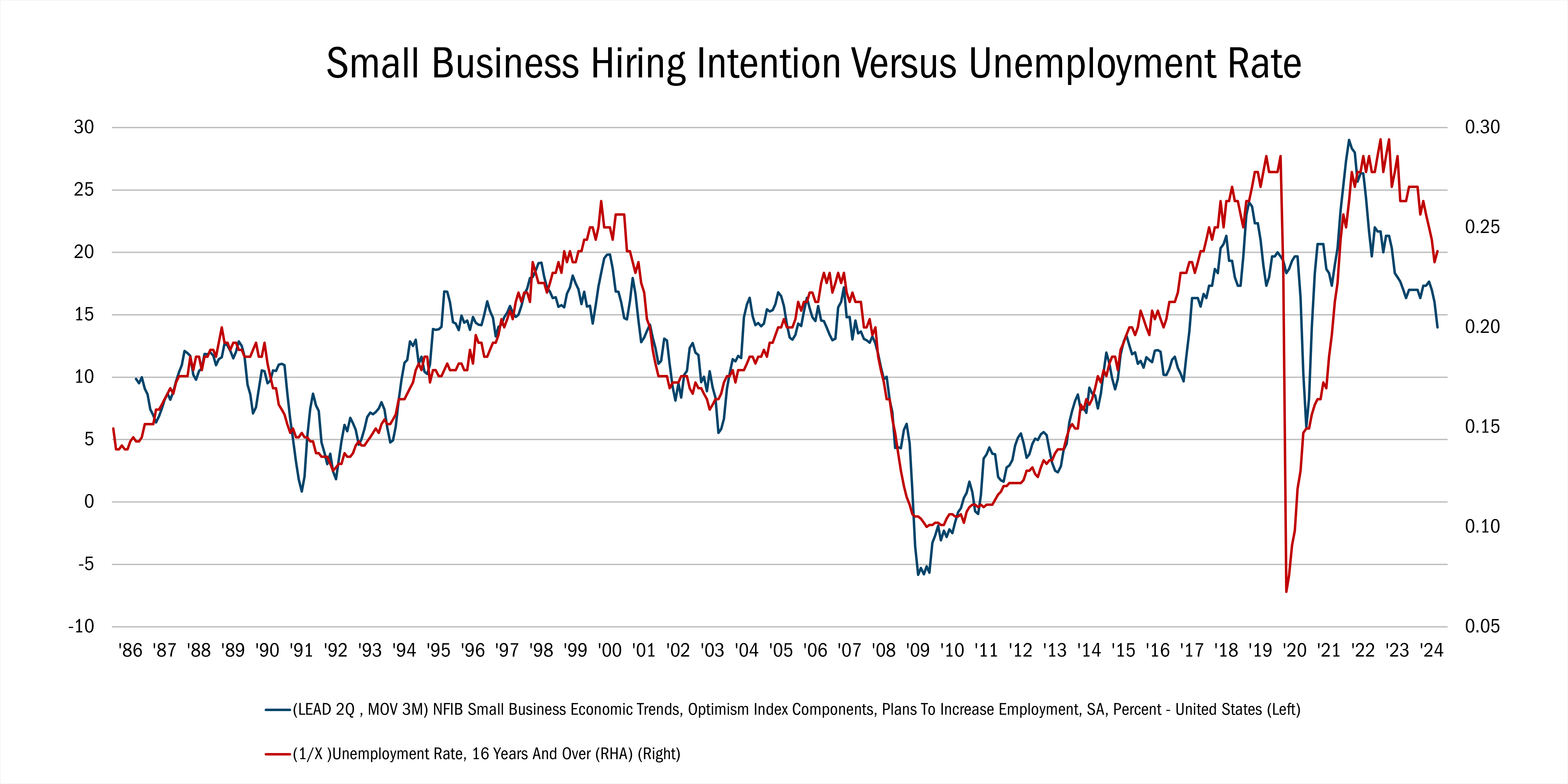

While policymakers anticipate making two more cuts before the end of the year, based on the Federal Reserve’s so-called ‘dot plot,’ the employment outlook is likely to get worse before it gets better. Recent surveys by Federal Reserve regional banks in New York, Philadelphia, Dallas, and Kansas City show manufacturing employment contracting. Meanwhile, there has been a strong historical correlation between the unemployment rate and two economic indicators — the NFIB Small Business Optimism Index and the ISM Purchasing Managers Index. Ongoing weakness in both indicates the potential for unemployment to climb from 4.2% today to around 6% (see below).

Source: FactSet Research Systems Inc., 1/31/1986 to 9/30/2024 This chart represents small businesses’ hiring intention compared to the unemployment rate. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

Against this backdrop, many investors will be looking to see if there is more collateral economic damage to come in the near term. Down the road, a silver lining in all of this could be that prospective stock returns are generally better from higher unemployment rates rather than low unemployment levels. That said, one should expect the unexpected along the way. Chalk it up to one of Warren Buffett’s rules — it pays to be greedy when others are fearful, a sentiment that works hand in glove with our 10 Principles of Value Investing™.

Attribution Analysis

The Mid Cap Value portfolio returned 8.32% in the third quarter, trailing the Russell Midcap® Value Index, which gained around 10.1%. Stock selection was positive in six of 11 sectors, led by Materials, Financials, Real Estate, Consumer Discretionary, Utilities, and Health Care. Despite our relative outperformance in those areas, we were underweight Consumer Discretionary, Real Estate, and Financials compared to the midcap value benchmark. At the same time, we were overweight in some sectors where our security selection was negative for the quarter, such as Consumer Staples, Energy, and Industrials. Over the past three- and five-years, our Strategy outperformed the Russell Midcap® Value Index driven almost entirely by security selection.

Portfolio Activity

In constructing our portfolio, we are guided by rules that keep us disciplined and help ensure that we can replicate our process. We start with a bottom-up approach that seeks to have security selection drive our performance. Overlaying our 10 Principles of Value Investing™, we implement a two-bucket strategy by seeking to own both high-quality companies trading at decent bargains (“quality value”) and deeply discounted companies that have produced poor economic returns over time (“deep value”). However, within deep value, we aim for companies that have identified an internal change agent that could help the company achieve its potential from an intrinsic value and share price perspective. We do this because these two styles within value investing tend to alternate market leadership, just as growth and value strategies generally take turns outperforming.

For every stock we consider, we also establish four price targets that allow us to consider how the market might value each of those companies under different scenarios. This gives us a framework for assessing stocks under various market conditions so that if circumstances change quickly, we can act decisively to take advantage of opportunities. This is particularly useful for stocks we keep on our watchlists, where a resumption of volatility could improve the risk-reward profile of the company.

Industrials. A company we added from our watchlist this quarter was Robert Half (RHI), a leading temporary staffing and consulting firm that places finance, accounting, and technology experts at small- and medium-sized businesses. Robert Half is an example of a quality value bucket company that we have owned in the past and that we can buy with confidence in the face of a business cycle slowdown. That confidence stems from a belief in the company’s competitive positioning, balance sheet, capital allocation, and proven ability to compound value for its owners over time. This is a playbook we have applied many times before when good businesses are going through a “soft patch.”

We originally held RHI in 2017 and 2018, during a cyclical downturn and subsequent recovery. We revisited RHI in the third quarter of this year after the company’s latest earnings call, in which management indicated that temporary staffing revenue had been lower on a year-over-year basis for seven consecutive quarters. By comparison, this length of decline is comparable to the recessionary conditions experienced in 2001-2002 and 2008-2009.

We believe the durability of RHI’s cash flows should prove greater than what the market is pricing in, and we are confident the company is underearning relative to normalized profitability. RHI enjoys industry-leading profitability and free cash flow generation. The company has no debt and has $500 million of cash on its balance sheet, which itself is worth more than $5 a share.

It goes without saying that staffing is a deeply cyclical business, and unemployment seems to be going the wrong way. Despite this reality, RHI historically tends to outperform the Russell Midcap® Value Index when the job market worsens. The stock is currently trading at relatively high earnings multiple, but we consider that a function of depressed profits. The stock’s free cash flow/enterprise value yield stands at more than 5% today — and greater than 10% based on what we believe is mid-cycle profitability. Meanwhile, 100% of Robert Half’s free cash flow is being returned to shareholders through dividend growth and buybacks.

Health Care. Another new holding from our quality value watchlist is Smith and Nephew plc (SNN), a leading medical device company for advanced wound care, sports medicine, and orthopedics.

The company has been hard at work for over two years implementing a badly needed self-help playbook. Those efforts are increasingly bearing fruit. While SNN’s wound care business enjoys a strong return on invested capital, its orthopedics group is well below peers or what is deemed acceptable. Management is taking several measures to improve asset utilization and capital allocation. Fixing the orthopedic segment’s performance can unlock significant value for shareholders.

The company has made considerable progress addressing high turnover among sales reps and filling gaps in its U.S. territory leadership. The company has also been improving several functions including manufacturing quality, warehouse productivity, third-party procurement, U.S. sales productivity, marketing efficiency, and overhead spending. The impact is already being felt, as shipments of its orthopedic knee products reached target levels in the second quarter, following a similar achievement for hips at the end of last year. That said, there remains work to be done as evidenced by the ortho segment’s meager revenue-per-manufacturing square foot compared to industry peers.

At 11X Enterprise Value-to-EBITDA, SNN trades at a significant discount to industry peers. Furthermore, profit margins are depressed by several hundred basis points due to the ortho segment inefficiencies. Continued progress on market share performance and operational streamlining should yield a “virtuous circle” of both margin growth and multiple expansion, in our view.

Consumer Staples. A convenience store operater was our worst performer during the quarter. The retailer, with more than 19,000 stores, 80% of which are in rural towns with populations of less than 20,000, recently slashed its 2024 earnings guidance, sparking a late-summer sell-off.

Same-store comparable sales and margin guidance were cut meaningfully, implying a significant slowdown in the second half of the year. While some of the troubles may be due to the financial challenges of its core customers, with average incomes of just $35,000, the store is also losing market share because of Walmart’s initiative to reduce entry-level pricing. Management acknowledged a need to invest in promotions to stimulate demand, but they refute concerns that the company needs to invest more in store-level labor.

We exited the position and harvested the tax losses, but we continue to monitor the company’s fundamentals. We’re looking for comparable sales to stabilize driven by promotional activity, a boost in labor investments, and management to downsize store expansion plans to improve free cash flow generation and accelerate deleveraging efforts.

Outlook

Though the Federal Reserve has finally begun its eagerly anticipated easing cycle, the move hasn’t flipped an automatic switch. The same economic concerns that drove the central bank to shift focus away from inflation and towards supporting jobs is likely to continue to motivate investors going forward. We believe this mix of cautiousness over the labor market and optimism surrounding rate cuts calls for discipline and patience, which reminds us of a famous Buffett saying: “We don’t have to be smarter than the rest. We just have to be more disciplined than the rest.” For us, that means not overreacting to the current news while staying true to our 10 Principles of Value Investing™, which have guided our Fund successfully for a decade since launching nearly ten years ago.