At first glance, it’s easy to think that the Federal Reserve’s decision to lower short-term interest rates in September removed a big uncertainty hanging over the market. The fact that Federal Reserve officials shifted their focus from fighting above-target inflation to supporting the job market likely explains the recent equity market rally, which lifted the S&P 500 Index and the Russell 2000® Index to new record highs.

But look under the hood and signs of concern and cautiousness seem to remain. Even as the Federal Reserve has embarked on its first easing cycle since 2019, money continues to flow into areas of ‘relative safety’ (nominal), including longer-dated bonds. In addition, companies sitting on large piles of cash have outperformed. Take Berkshire Hathaway, one of the top holdings in our Strategy. Warren Buffett and team have been selling stocks more aggressively than they have in over two decades. As a result, Berkshire entered the third quarter with over $275 billion in cash and cash equivalents. Although cash represents more than one-fourth of the company’s total equity value and lower interest rates are an earnings headwind, the stock hit a new high and outperformed in the quarter.

The September rate cut may have answered some questions about the direction of monetary policy, but it also highlights the risk of making a future policy error, in either direction. To be clear, we agree with the Federal Reserve’s conclusion that restrictive policy would further dampen economic activity (not that we can forecast interest rates); however, further meaningful interest rate reductions could indicate a deteriorating labor market. Jobs have traditionally been the ultimate decider on where the economy goes, and though the current unemployment rate of 4.2% is low by historical standards, it’s almost a percentage point higher than in early 2023.

Investors appear to be paying attention, as the last two major spikes in market volatility took place in early August and early September, coinciding with the release of the Labor Department’s two most recent jobs reports. On August 5th, the CBOE Volatility Index, a fear gauge priced by the options market, climbed to its third-highest reading in 20 years, reaching a level only exceeded by the financial crisis in 2008 and the global pandemic in 2020.

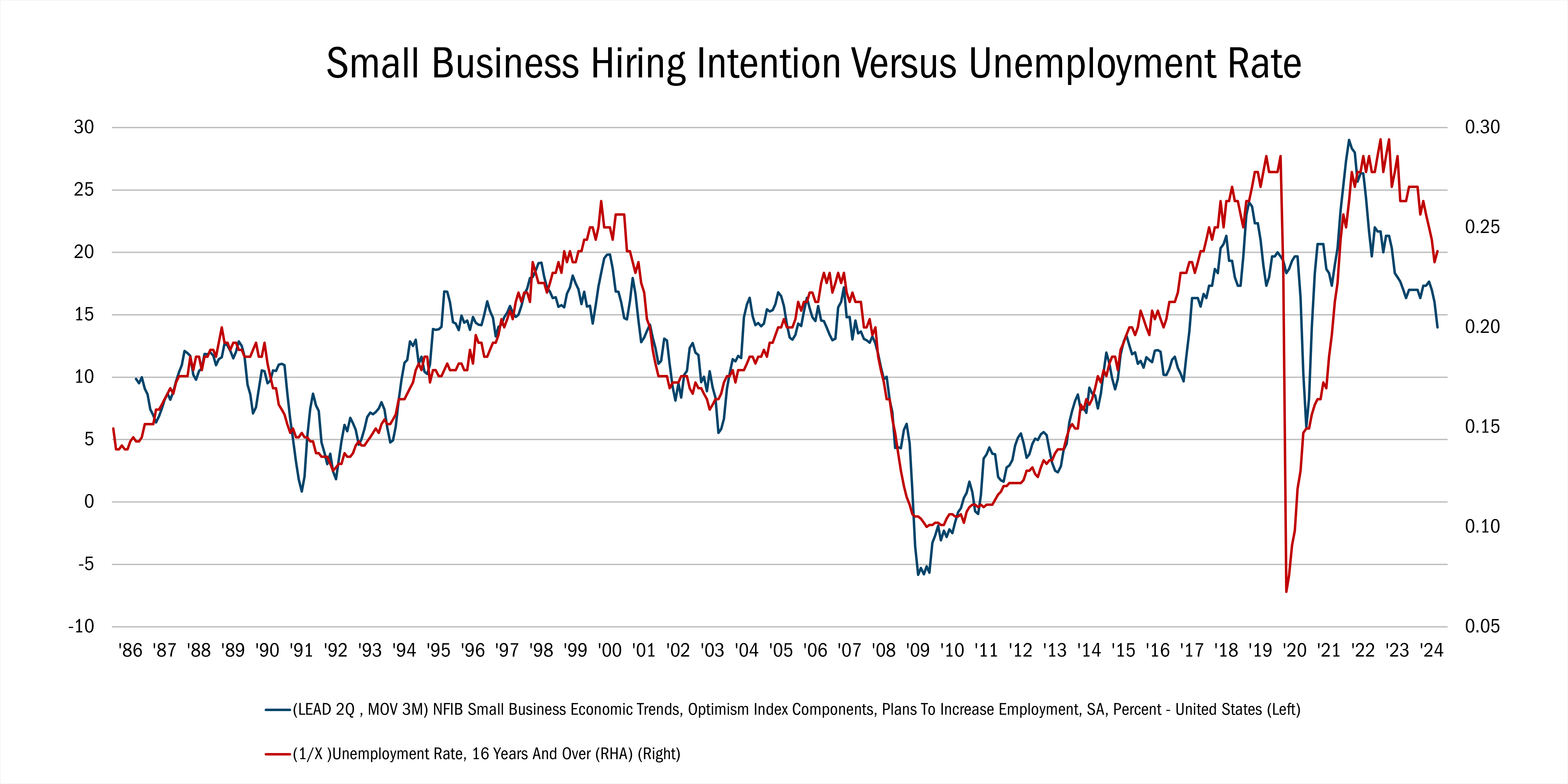

Don’t be surprised if anxiousness persists with the job market softening even as the Federal Reserve has shifted into a less restrictive mode. Historically, there has been a strong correlation between the unemployment rate and two economic indicators — the NFIB Small Business Optimism Index and the ISM Services Purchasing Managers Index. Ongoing weakness in both indicates the potential for unemployment to climb to around 6% (see below).

Source: FactSet Research Systems Inc., 1/31/1986 to 9/30/2024 This chart represents small businesses’ hiring intention compared to the unemployment rate. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

Concerns surrounding the demand for labor have already led to major intra-quarter swings in the market that belie the overall gains in major benchmarks. For instance, small-cap value stocks outpaced large-value by more than 7% from the end of June to late July only to reverse and underperformed by more than 6% in the subsequent three weeks, thanks to the weak jobs report that triggered a selloff. We would not be surprised to see further volatility until the labor market finds its footing. In the meantime, we are comforted by the fact that our all-cap Strategy is uniquely positioned to take advantage of opportunities whether they arise in small-, mid-, or large-cap businesses, as long as they fit within our 10 Principles of Value Investing™ process.

Attribution Analysis

Our Strategy rose 8.76% in the third quarter, trailing the Russell 3000® Value Index, which returned 9.47%. Stock selection was favorable by about 0.5% led by Consumer Discretionary holdings, but this outperformance was more than offset by our overweight to underperforming holdings in the Consumer Staples sector and a modest cash position.

While many of our top contributors in the quarter were large-caps stocks, including Berkshire Hathaway (BRK.B), small-cap stocks in Deciles 4 and 5 generated our best performance. Our holdings in Decile 4 (businesses with market caps between $3.5 billion and $6.4 billion) returned 14.98%, compared with 9.28% for the same grouping within the Russell 3000® Value index. In Decile 5 (market caps between $2 billion and $3.5 billion), our portfolio gained 17.2%, versus the benchmark’s 9.55%.

Portfolio Activity

In the third quarter, our mid-cap weighting rose modestly to 35%, up from 30% at the end of June driven by new holdings including several mid-sized industrial companies. We want individual security selection to drive our performance, not factor bets, including those on company size. That’s why we construct our portfolio from a bottom-up perspective, as exemplified in the following holdings:

Industrials. An industrial company added this quarter was Robert Half (RHI), a leading temporary staffing and consulting firm that places finance, accounting, and technology experts at small- and medium-sized businesses. Though staffing is a deeply cyclical business, Robert Half’s relative performance is positively correlated with a weakening job market. So, rising unemployment could, ironically, be a favorable catalyst for RHI shares going forward.

Industrials. An industrial company added this quarter was Robert Half (RHI), a leading temporary staffing and consulting firm that places finance, accounting, and technology experts at small- and medium-sized businesses. Though staffing is a deeply cyclical business, Robert Half’s relative performance is positively correlated with a weakening job market. So, rising unemployment could, ironically, be a favorable catalyst for RHI shares going forward.

This is not our first time owning the company; we held Robert Half in 2017-18 during a modest cyclical downturn and subsequent recovery. We revisited the company in the aftermath of a more than 50% drop in the stock from its all-time high achieved in early 2022. RHI shares fell to their lowest level since 2020 because demand for their services had declined on a year-over-year basis for seven consecutive quarters, a length of fundamental pressure only rivaled by the recessionary conditions experienced in 2001-2002 and 2008-2009.

However, we believe the durability of RHI’s cash flows should prove greater than what the market is pricing in, and we’re confident the company is underearning relative to normalized profitability. RHI enjoys industry-leading profitability and free cash flow generation. The company has no debt and has $500 million of cash on its balance sheet, equivalent to more than $5 a share.

The stock is currently trading at a high earnings multiple of nearly 22X, but that’s because, in our estimation, profits are depressed. Free cash flow to enterprise value yield is more than 5% today — but greater than 10% based on what we believe is mid-cycle profitability. Meanwhile, 100% of Robert Half’s free cash flow is being returned to shareholders through dividends and buybacks. We expect revenue to continue falling for several quarters, but we believe the upside potential is asymmetrically skewed relative to downside risks.