Animal spirits that stirred in September when the Federal Reserve began cutting interest rates sprang to life in the fourth quarter following a Republican sweep of the White House, Senate, and House of Representatives. The S&P 500 Index rose 2.41% in the final three months of the year while the Russell 2000® Index of small stocks jumped 0.33%.

Speculation helped drive the market for much of the quarter, as investors seemed willing to bet on the perceived winners and losers of President-elect Trump’s economic agenda. Cryptocurrencies along with artificial intelligence-focused companies were immediately put into the winner’s bucket, so it wasn’t surprising that growth surged ahead of value in the quarter. The S&P 500 Growth Index rose 6.17% in the quarter while the S&P 500 Value Index was largely flat, registering a loss of 2.67%.

The market seems to be looking beyond current fundamentals and pricing in significant deregulation across industries, relying on faster expected economic growth to justify elevated valuations. It’s possible deregulation could come to pass, but there are no guarantees that the incoming administration’s efforts will succeed in accelerating GDP growth to the degree the market now expects. If these efforts fall short or fail to be realized, there are downside risks to consider. For instance, long-term Treasury yields, which act like gravity on valuations, rose meaningfully in response to the pro-growth and protectionist strategy outlined by the incoming administration. The 10-year Treasury yield rose from approximately 3.8% heading into the fourth quarter to approximately 4.5% by year end, and interest rate sensitive industries, like housing, are suffering in real time.

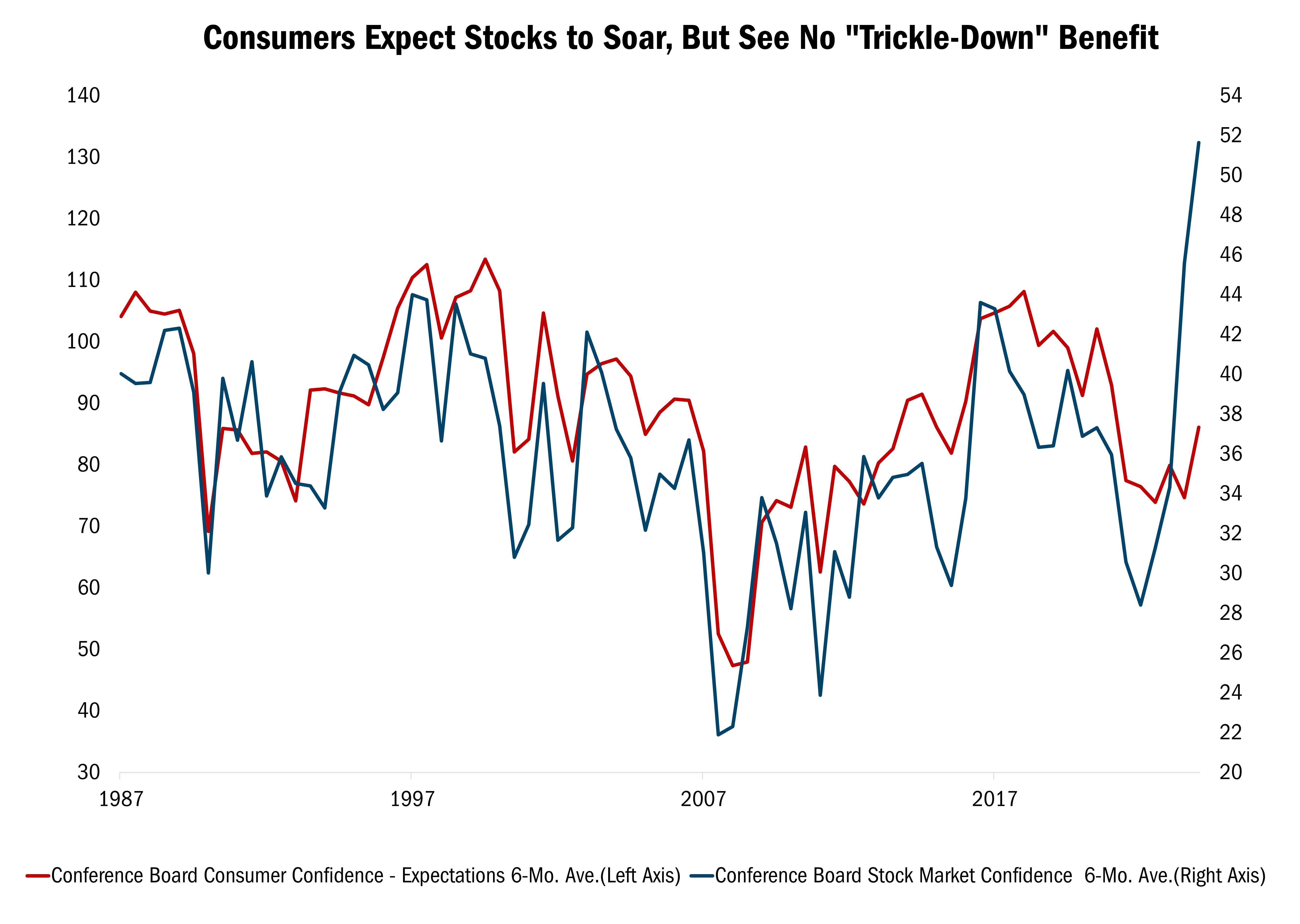

At the moment, the market doesn’t seem to care about the details; it is simply reacting to the big picture. Historically, confidence that stock prices will rise in the coming year has largely mirrored consumer sentiment. Lately however, investor confidence has jumped while consumer confidence expectations, a gauge of how individuals feel about the economy, remain lukewarm (see the chart below).

Source: The Leuthold Group and The Conference Board, semiannual data from 12/31/1987to 12/31/2024. This chart represents the comparison of the Conference Board Consumer Confidence expectations to the Conference Board Stock Market Confidence. CEO Confidence Survey (Conference Board) is a monthly survey of 100 CEOs from a variety of industries in the U.S. economy. The survey is conducted, analyzed, and reported by the Conference Board, and it seeks to gauge the economic outlook of CEOs, determining their concerns for their businesses, and their view on where the economy is headed. A reading above 50 indicates that the CEOs surveyed are more bullish than bearish on their economic outlook. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

What makes this interesting is that investor confidence and consumer sentiment are typically seen as contrarian indicators, meaning equity returns are often better when conviction is low. Given how jubilant investor expectations seem to be, it probably makes sense to take a step back and put the market’s mood in perspective.

Our responsibility is not to lose sight of what businesses are worth on a bottom-up basis. In our opinion, pockets of the equity market are detaching from reality. For example, a company called MicroStrategy (MSTR), which is in our benchmark, has risen by more than 25-fold since 2020 to an enterprise value exceeding $105 billion. This business must be growing like a weed, right? In fact, MSTR’s revenues have fallen by 4% from $486 million in 2019 to an expected $468 million in 2024, with sales down in four out of five previous years. MicroStrategy’s core business is an underperforming software business with a highly generous value of approximately $5 billion, assuming a software industry sales multiple of 12X revenue. The software business, in our estimation, is worth far less than $5 billion as evidenced by the less than 2X sales multiple ascribed to underperforming software peers, implying a fair value of less than $1 billion.

What accounts for the remaining $100 billion plus of ‘value’? It’s MSTR’s ownership of bitcoin, a popular cryptocurrency, plus a very large premium to asset value assigned by today’s market. In 2020, MSTR’s management decided to start acquiring bitcoin by raising debt and equity financing, a clear sign the software business is impaired. We won’t even speculate on whether bitcoin has value. For argument’s sake, assume the market fairly values bitcoin at approximately $110,000 per digital token, a price that implies MSTR’s bitcoin holdings are worth approximately $48 billion . Why would anyone value MSTR at more than $100 billion when the ‘intrinsic value’ of all underlying assets is worth half as much? Our answer: speculation. The market is speculating that MSTR’s leveraged strategy will result in an ever-rising price of bitcoin, an asset that produces no cash flow and, as such, is valued based upon what someone else is willing to pay. To be clear, we have no idea when this ends, but we’d observe that such misallocation of capital tends to happen in times of market excess. We try to spend our time avoiding such exuberance.

Against this backdrop, we continue to look for compelling opportunities guided by our 10 Principles of Value Investing™, which focus on attractively priced, well-managed businesses that can grow intrinsic value throughout market cycles.

Attribution Analysis

Our Strategy was down 2.79% in the fourth quarter, underperforming the Russell 3000® Value Index, which fell 1.94%. Stock selection was mixed in the quarter, with positive stock selection in 4 of 11 sectors, led by Communications, Health Care, and Materials. At the same time, selection had a negative effect in several sectors including Technology, Real Estate, and Financials.

Our performance was affected both by what we held in the portfolio as well as parts of the market we underweighted or didn’t own, including MSTR. For example, three of our best-performing stocks in the quarter were Financials, which benefitted from the anticipation of a deregulatory regime under the new administration. Banks and consumer finance stocks, in particular, were the best performing industries within the sector. Though our Bank holdings performed well in the fourth quarter, we are underweight that group relative to the benchmark, and we don’t currently own any consumer finance businesses.

Portfolio Activity

We construct our portfolio from a bottom-up perspective, based on the specific opportunity we see in individual companies, not sectors or cap sizes. Our goal is to have security selection drive our relative performance and to have our 10 Principles of Value Investing™ guide our portfolio decisions, as illustrated by the following companies: