In one respect, this was another challenging quarter for small-cap investors, as the Russell 2000® Index fell 3.28% while the S&P 500 Index gained 4.28%. But it was also a market in which some green shoots began to sprout up, giving disciplined bargain hunters, like us, hope that the markets can and will eventually broaden out.

Though investors’ infatuation with mega cap tech continues, we spent the quarter looking for budding opportunities. Specifically, we are searching for companies with stabilizing year-over-year sales that should soon see an uptick in earnings, either because pricing dynamics are starting to move their way or because the self-help strategies they’ve implemented to improve operational or strategic performance are gaining traction. We are looking across a variety of industries, though more of these prospects are likely to be found in parts of the market that benefit in the early stages of a recovery, such as Industrials and Consumer Discretionary companies. Regardless of the type of business, the ultimate goal is to identify management teams with strong capital allocation policies as a foundation for delivering shareholder returns.

Our search for such stocks is taking place entirely from a bottoms-up perspective, which is how we construct our portfolio. From a top-down point of view, though, there are also signs of promise, especially as the earnings outlook is coming into sharper focus.

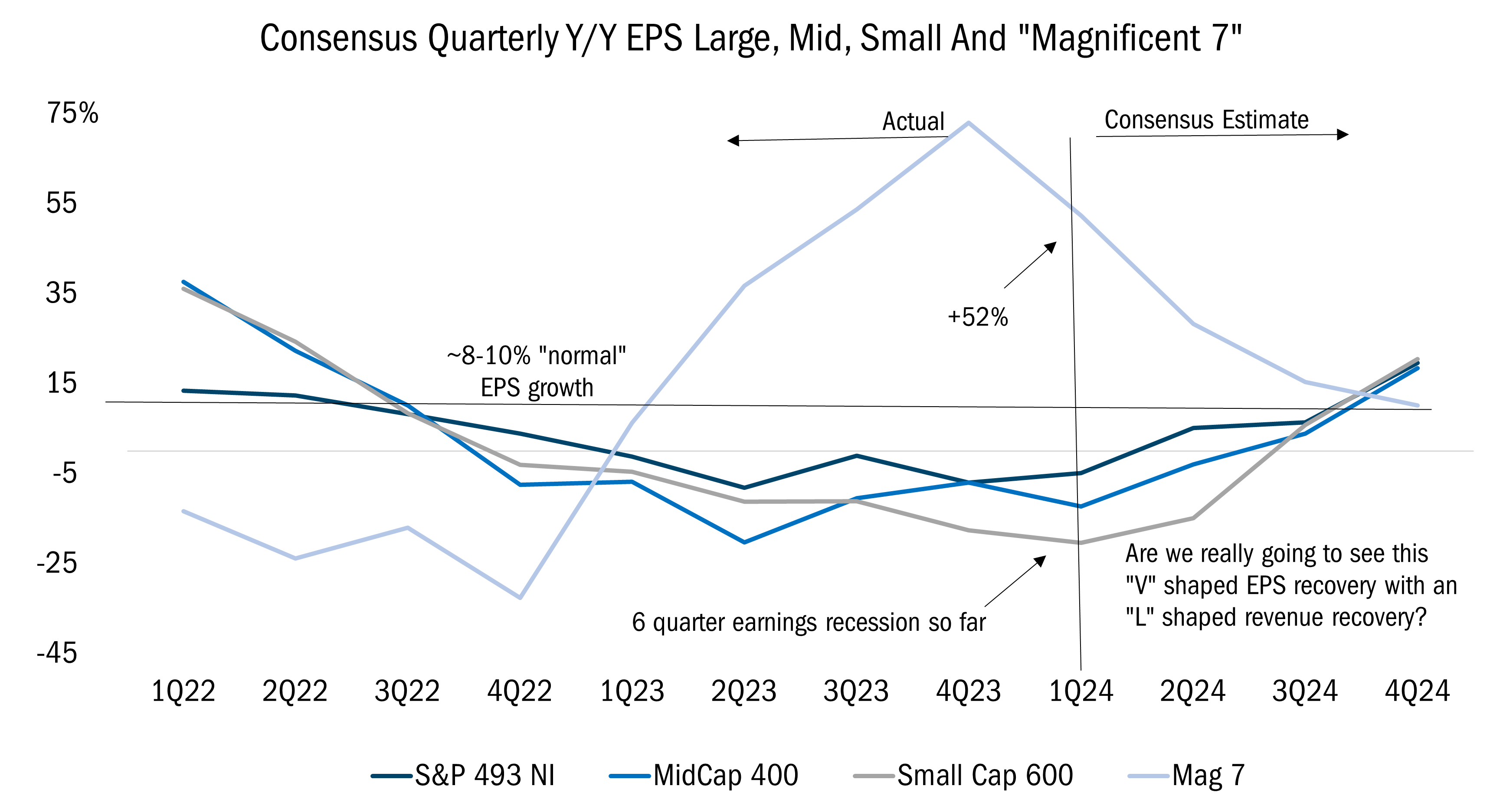

Heading into the year, expectations were that profits for large caps would begin to wane, potentially redirecting investor attention to the smaller end of the market capitalization spectrum. In the first quarter, however, forecasts for small-cap earnings declined while S&P 500 profit estimates improved. Nevertheless, a reversal of fortune is still expected in the latter half of this year — especially once the Magnificent 7 tech stocks are removed from the equation (see chart below).

Source: Raymond James research, FactSet Research Systems, Inc. Quarterly data from 1Q22 to 4Q24. This chart represents the Consensus Quarterly Y/Y EPS Large, Mid, Small, and "Magnificent 7" by reflecting the S&P 500, S&P Midcap 400, S&P Small cap 600 - utilizing actual results from 1Q22-1Q24, consensus estimates 2Q24-4Q24. Only Nuance is we have separated S&P 500 into the "Mag 7" and everything else, which we call S&P 493. All indices are unmanaged. It is not possible to invest in an index. Past performance does not guarantee future results.

This gives us confidence that a rebound in small-cap performance, based on the fundamentals, is possible. If that occurs, the improving backdrop could provide a decent dose of operating leverage to those ‘green shoots’ we are focusing on.

Attribution Analysis & Portfolio Activity

In the second quarter, the Value Plus Strategy was down 7.34%, trailing the Russell 2000® Value Index, which fell 3.64%. Stock selection, particularly in the Consumer Discretionary, Financials, and Energy sectors, contributed to the underperformance. However, selectivity helped the Strategy outperform the benchmark in the Information Technology, Health Care, and Utilities sectors.

We initiated positions in several new holdings while exiting or reducing our exposure in a handful of others. We believe our portfolio is well represented by secular winners that exhibit defensive attributes. We are trying to balance this out by adding exposure to higher-quality companies with more cyclical characteristics trading at trough multiples while at trough earnings. If management knows how to allocate capital effectively and self-help is sprinkled in, these are businesses where even modest demand growth could lead to a material improvement in their operating performance.

This effort has led to a slight uptick in turnover, but we remain steadfast in focusing on well-managed small-cap companies with low leverage, solid balance sheets, and a strong capital allocation process in place, which are part of our 10 Principles of Value Investing™. We also favor companies deploying self-help strategies to improve their competitive standing and profitability. Finally, we gravitate towards companies and management teams providing signals (buybacks and insider buying) that shares are undervalued. More than 85% of our holdings are engaged in active buybacks, which is the highest percentage in recent memory, and many holdings had insider buying during the quarter.

These are companies like Kennametal, Inc. (KMT), the manufacturer of industrial cutting tools and components that we mentioned in our Q1 commentary. The company is emerging from trough demand and has seen EBITDA contract on a year-over-year basis in 5 of the last 7 quarters. But the company has been undergoing extensive self-help during the past 5 years, taking out $200 million in structural costs, cutting its headcount by 20%, and closing 6 plants as part of an extensive restructuring. The heavy lifting/investment phase seems to now be in the rearview mirror. While demand has not yet inflected higher, sales are stabilizing. If Kennametal sees even a slight pickup in demand in its end markets, that could provide an immediate and robust boost to its operating margins. Furthering our confidence, KMT’s newly appointed CEO purchased shares in the quarter and the company is active on its buyback program.

We see a similar opportunity in Science Applications International Corp. (SAIC), which offers a range of IT services to its customers.

SAIC has faced recent challenges with lower-than-average government contract renewals and lower demand for their IT services, prompting the appointment of new management to address business development concerns. We purchased shares of SAIC in the second quarter on the premise that the new management team, led by a CEO previously with Microsoft, will be able to succeed in two key self-help efforts: increasing the volume of SAIC bids and improving the firm’s below-average industry "recompete rates," which consist of rebidding on previously awarded expiring government contracts that are typically 5 years in length.

These efforts, coupled with internally focused capital allocation strategies that include dividend growth and active share buybacks, are likely to drive price appreciation for the stock. In the meantime, SAIC shares trade at a modest 13 times forecast earnings with a strong 8% free cash flow/enterprise value yield. Additionally, SAIC’s newly appointed CEO and CFO purchased shares during the quarter — suggesting to us the management team is confident in future prospects at SAIC.

Outlook

While mega-cap stocks continued to be the focus of investor interest, that won’t always be the case. There are fundamental reasons to believe the market will eventually broaden out, and it is our job to identify undervalued, overlooked companies that are likely to benefit when that turns takes place. We have been looking for these potential green shoots and are encouraged by some of the opportunities we are seeing. Until those budding opportunities fully bloom, though, we are comforted by the fact that the companies we own are allocating capital wisely and taking steps to improve their competitive and operational standing. That’s why we are confident our disciplined approach — focusing on companies with low trading multiples, strong free cash flow, solid balance sheets, and sound capital allocation as outlined in our 10 Principles of Value Investing™ — will guide us well as the market transitions.