Sometimes, it’s almost impossible, even for long-term minded investors, to completely ignore the noise. The first quarter was one of those markets.

Nobody — not large institutional investors, advisors, economists, or individuals — really knew what was coming next in the flurry of policy shifts ranging from tariffs to spending cuts at the start of the year. With businesses and consumers expecting more fiscal shoes to drop, many held off making big decisions, reducing the pace of new hiring, investments, and spending in the quarter, leading to a selloff. As you’d expect, the corresponding flight to safety hit small stocks harder, with the Russell 2000® Index down around 9.5% in the first quarter, compared with the 4.3% decline for the blue chip S&P 500 Index.

There is something, however, that successful value managers know when it comes to navigating times like this. When the macroeconomic picture begins to blur, it often makes sense to focus on the micro. That’s how some of the smartest investors in history, such as Warren Buffett and Peter Lynch, found their success. Lynch famously noted that in every era, there has been an existential fear about the economy, geopolitics, or fiscal policy that seemed as if it might derail the market’s long-term upward trajectory. The mistake that many make is letting those top-down worries drive them out of equities rather than concentrating on the opportunities presenting themselves from a bottoms-up perspective.

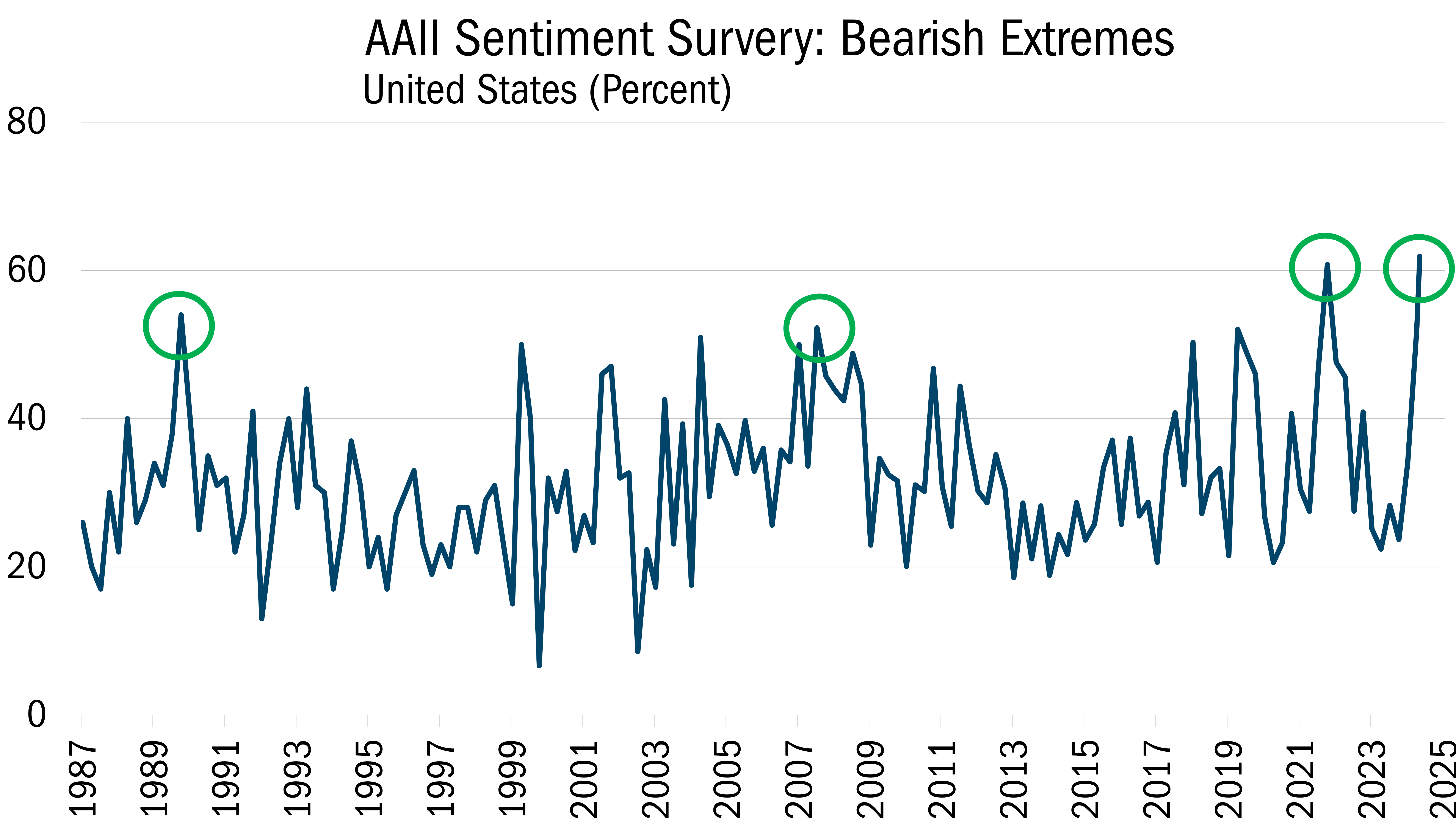

At the end of March, bearishness tracked by the American Association of Individual Investors climbed to a reading of 52.2, a level that’s only been reached a few times in recent memory. This amount of fear was last seen in the global financial crisis in 2008-2009 and the recession of 1990.

Source: Bloomberg. Quarterly, 9/30/1987 to 4/3/2025. The data in this chart represents the American Association of Individual Investors Sentiment Survey and the rise of bearishness over time. All indices are unmanaged. It is not possible to invest in an index. Past performance does not guarantee future results.

We believe focusing on the micro and understanding the underlying strengths and vulnerabilities of companies in our Strategy helped us navigate the choppy market during the quarter. In our view, the logical response to uncertainty is to think about as wide a range of outcomes as possible, which is what our approach requires us to do. For every company we hold or consider, four price targets are established to weigh both upside potential and downside risks. Those reflect best-case, base-case, downside-risk and max-downside-risk scenarios. By doing so, we try to go into every situation already knowing what to expect should circumstances change for the worse.

This bottoms-up perspective also gives us another advantage: It shows how much value there is in this market and gives us reason to be optimistic. Our holdings in the Heartland Value Fund, for instance, are trading at just 10 times earnings for the next 12 months, representing an earnings yield of 10%. Valuations are just one component of our 10 Principles of Value Investing™, which focuses on identifying attractively priced, well-managed businesses with sound finances and business strategies that will help them grow throughout an entire cycle.

Attribution Analysis & Portfolio Activity

For the quarter, the Heartland Value Strategy fell 3.23%, compared with the 7.74% decline for the Russell 2000® Value Index. We outperformed the benchmark not just during the last three months but also over past 1, 3, and 5 years. Stock selection accounted for all our outperformance in the quarter and was particularly strong in Energy, Materials, Technology, Consumer Discretionary, and Financials.

During the quarter, we were willing to take what the market was giving us. The conditions may not be ideal, but uncertainty gives rise to fear, bringing about lower stock prices, which provides patient, disciplined investors like us with opportunities.

Recently, we’ve been willing to add to positions in companies where the fundamentals make sense and that have promising levels of insider buying to confirm our views. A good example is Columbus McKinnon Corp. (CMCO), which we initially added to our Strategy in the first quarter. The company designs, manufactures, and distributes materials, handling products, and systems used in a variety of industrial applications, including lifting, precision conveyance, and linear motion.

Historically, CMCO’s growth has been largely driven by changes in manufacturing activity. A new CEO joined the business in June 2020 with the goal of higher growth and margin applications while increasing the recurring revenue mix. CMCO, however, reported a softer recent quarter due to slowing industrial demand driven by U.S. policy uncertainty. The company also announced a $2.7 billion acquisition of competitor Kito Crosby, which sent the stock plummeting 41% due to uncertainty around execution and an increased leverage profile of 4.8x upon closing.

We believe Columbus McKinnon offers investors a compelling risk/reward case and a strong catalyst as it seeks to reduce leverage and improve the growth and margin profile of the consolidated business. Management, which has been aggressively purchasing the stock in the open market during the recent sell-off, is targeting mid-20% EBITDA margins upon integration. That’s up from an estimated 15.5% in FY25 pre-acquisition. At the end of the quarter, the stock was trading at about $17 a share. Our current target price target of $54 would imply a valuation of 10.5 times Enterprise Value to EBITDA. Upon execution of the acquisition, however, we believe CMCO should be treated similarly to its industrial peers trading at an average of 12x EV/EBITDA. However, Columbus demonstrates that fundamentals aren’t enough. Our 10 Principles of Value Investing™ demand there be a strong catalyst for recognition to justify holding a stock.

As the Trump administration’s policies and global jitters rattled the markets during the quarter, investors flocked to precious metals. Gold closed the quarter at a record high of around $3,150 per ounce while silver and copper advanced around 20% for the period. In a dollar-debasing environment, owning physical gold and other metals is receiving increased interest from central banks worldwide as well as an increasingly wide range of investors, both young and old.

For some time we have been supportive of holding hard asset producers such as well financed, profitable miners and their allied providers. A standout performer has been a Canadian producer, New Gold (NGD), owner of the Rainy River gold mine and New Afton copper/gold mines.

The stock has more than doubled this past year, buoyed by increased production, higher grades and reserves, plus lower costs providing a substantial increase in free cash flow. With all-in sustaining costs (AISC) less than $1,400 per ounce, NGD is positioned to prosper. However, now priced in excess net asset value, NAV, we have taken advantage of increased interest and higher prices by trimming holdings. The proceeds were utilized to increase our holdings in two other miners which our research indicates are priced at 50% discounts to their NAV’s.

Outlook

This is what active management is all about. The two great emotions in investing are greed and fear. Within less than two quarters, this market swung from one to the other. Will tariffs lead to a slowdown, recession, or something worse? Nobody knows with absolute certainty. But if there’s anything we’ve learned in the 40+plus years of managing money, it’s the folly of trying to guess what’s going to transpire at the macro level in the short-term.

What really matters is being able to control your emotions and focus on the micro over the long run in conjunction with a risk management mindset. When you do that and follow Peter Lynch’s advice by getting to know what each of your companies is doing, you will discover how much value there is for those willing to do the research. We believe today’s emotionally charged extreme is setting up opportunities for the active, value-based investor.

Fundamentally yours,

The Heartland Investment Team