The third quarter showed how easy it is to get caught up in the horse-race aspects of investing. As the Federal Reserve moved to cut interest rates in September, questions immediately arose: Who are the likely winners and losers of an accommodative monetary policy? Which equities might be headed higher or lower over the course of the easing cycle? And is this the catalyst that could finally propel small value ahead of large growth?

This can be a pointless exercise, especially since the answers are almost never clear, nor instantaneous. For example, while history tells us that value stocks will eventually come back into favor, additional patience may be required, as growth doesn’t typically relinquish its advantage until midway into an easing cycle, according to research by The Leuthold Group.

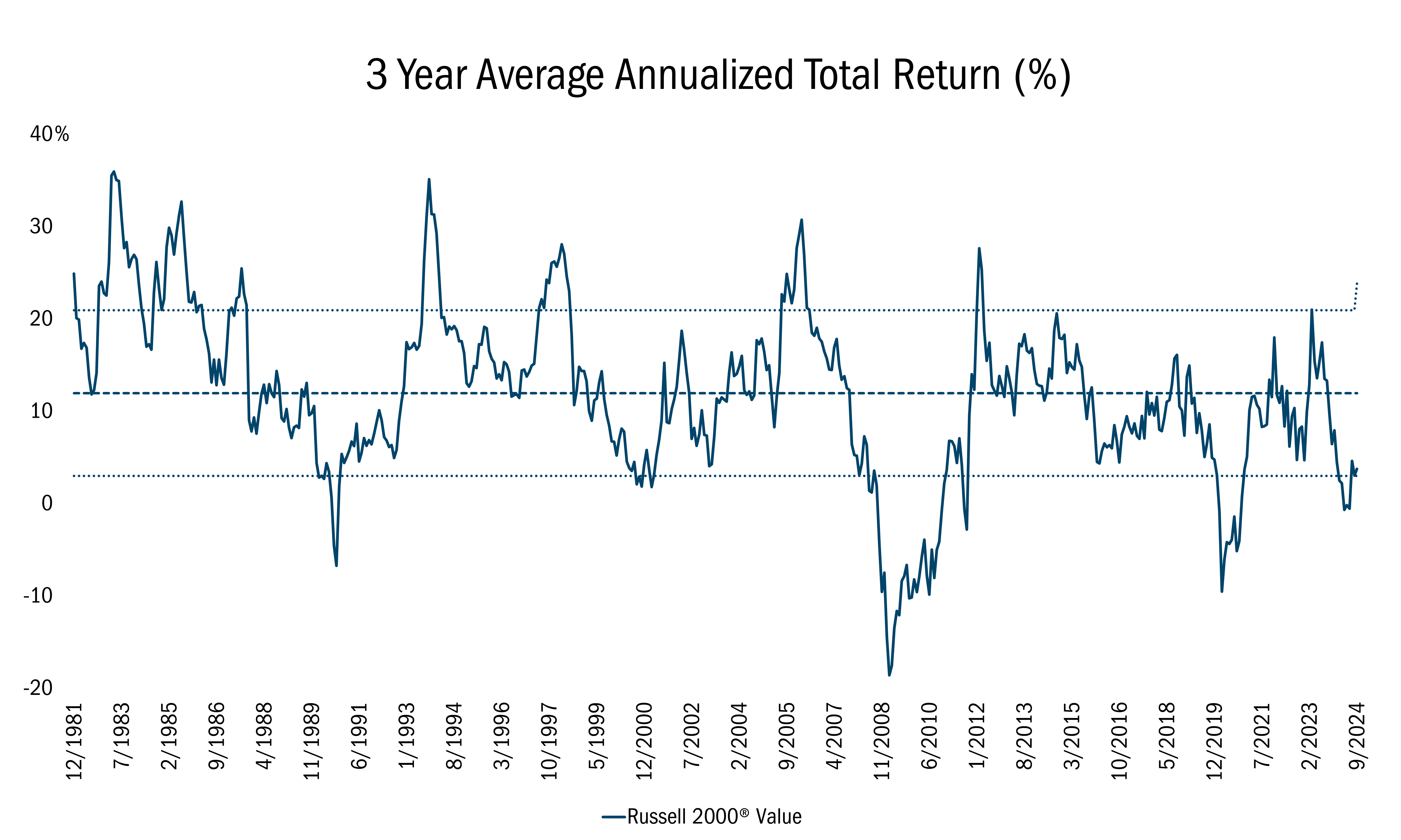

Similarly, while we believe small caps will benefit from lower borrowing costs, the economic concerns that drove the Federal Reserve to act may continue to pressure emerging businesses in the short term. That’s why it’s important to identify companies with strong financials and healthy free cash flow, without overpaying, as outlined in our 10 Principles of Value Investing™. Of course, this area of the market has performed so poorly, relatively speaking, over the past three years, that the bar is set pretty low for this group (see chart below). This gives us confidence in the opportunity set for our asset class, even if the precise timing is unclear.

Source: FactSet Research Systems Inc. and Russell®, monthly data from12/1/1981 to 9/30/2024. This chart represents the 3-year average annualized total return percentage for the Russell 2000® Value Index. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

In times like these, we are reminded of the words of Hall of Fame quarterback turned successful commercial real estate investor Roger Staubach, who argued that winning shouldn’t be measured by how far ahead you are of others in any short time period. Instead, it’s how much you grow in your own development and capacity in the long run.

We agree. At Heartland, our 10 Principles of Value Investing™ guide every investment decision we make. While those rules are unwavering, we are committed to looking for new and more effective ways to put our beliefs into practice with the goal of delivering consistent performance over time.

Attribution Analysis & Portfolio Activity

For the quarter, the Heartland Small Cap Value Strategy gained 11.52%, outpacing the Russell 2000® Value Index, which returned 10.15%. Security selection was mixed over the past three months, with the Strategy outperforming the benchmark in Consumer Discretionary, Energy, and Industrials. We lagged in other areas such as Information Technology and Health Care.

Year to date, the Strategy is up 14.97% versus 9.22% for the Index, with security selection being the primary reason for the outperformance. Stock picking was also the major driver of our performance over the past one, three, and five years.

It is worth noting that we don’t select securities in a vacuum. We are constantly assessing the portfolio’s overall risks and short falls. Then we identify ideas that are both attractive from an upside/downside perspective that can play a key role in addressing deficiencies in our Strategy. This active awareness is a critical part of our process. It is akin to constructing a winning football team. The impulse in every NFL draft may be to select the best quarterback coming out of college. But that may not make sense if you already have a franchise QB and need to shore up your defense. That’s how we go about picking stocks — we look for situations where our needs and opportunities converge.

A good example is Centrus Energy Corp. (LEU), a trusted supplier of components and services for the nuclear power industry. We generally aim not to deviate too far from the sector weightings of our benchmark, preferring to let security selection and our 10 Principles of Value Investing™— not industry bets — drive our performance relative to our active and passive peers.

After selling a long-term oil producer, Berry Petroleum (BRY), earlier this year, the portfolio was underweight Energy, so we’ve been aware of the potential need to boost our exposure. For years, we had been monitoring and meeting with the management of Centrus due to its unique position as America’s only licensed uranium enrichment company. Since 1998, Centrus has been providing utility customers with a clean, reliable, and affordable carbon-free power source. With world-class technical and engineering capabilities, Centrus is advancing the next generation of centrifuge technologies to restore domestic enrichment capabilities rather than relying on foreign sources, such as Russia.

Due to various regulatory delays, however, the stock had fallen out favor with investors, selling off substantially from former highs. After thorough research, we updated our review of LEU’s business, including potential competitors, and Centrus scored favorably on our grid using the 10 Principles of Value Investing™.

We established a position in the Spring, and as orders grew for their services, we added to the holding throughout the year. Centrus is profitable with a solid balance sheet that includes cash 2.5X their debt.

By contrast, we exited a successful metals and mining holding this year because its grid score deteriorated. As interest in gold has grown, shares of the company, which acquires and manages precious metal royalties worldwide, appreciated substantially. However, production difficulties at one of their key producing mines surfaced, thus reducing our estimates of earnings and cash flows. Together these increased the risk while lessening the reward potential for the holding, causing our valuation of the company to fall, and putting it at the bottom of the mining stocks in our portfolio. With a price to cash flow ratio of close to 20X and the grid score deteriorating to only 5 of 10, we believed there were better values elsewhere.

For example, our research indicated the outlook for New Gold (NGD), a pure Canadian gold and copper producer, was steadily improving. NGD has met guidance for eight consecutive quarters, as both of its mines are hitting their production stride. The company is forecast to tap approximately 600,000 ounces of gold equivalent in FY2026, up 42% compared with last year’s output. Excellent drilling results coupled with better efficiencies have reduced New Gold’s all-in sustaining costs (AISC) to $1,381 per ounce of gold, down from a recent high of $1,657. The company is on track to slash AISC’s more than 50% by 2026.

Under new management headed by CEO Patrick Godin, who joined in 2022, NGD is enjoying financial flexibility that allows for exploration to grow reserves and extend the life of mines. The team continues to execute significantly increasing production, cutting costs, and posting exceptionally strong free cash flows. Our research process was validated by strong insider buying in the company. Yet despite doubling in value, NGD was priced at 8x our estimated 2025 earnings, less than 6.5x free cash flow and scored 8/10 on our research grid. We added to the position.

Outlook

Although our confidence in small value stocks is unwavering based on the unrecognized opportunities in this segment, we believe patience will be required. We expect the backdrop for this segment to improve, as the Federal Reserve embarks on its first easing cycle since the global pandemic. However, historically these policy turns have taken longer than expected to unfold. While we wait patiently, we remain committed to staying true to our 10 Principles of Value Investing™ while constantly improving our process to optimize our performance over time.

We thank you for your continued trust and confidence in Heartland.

Fundamentally yours,

The Heartland Investment Team