The euphoria in today’s equity market is breathtaking and unsustainable in our view. Since the election, Bitcoin jumped 34% ($2 trillion in market value) in anticipation of fewer regulations under the Trump administration. That same theme put more wind in the sails of mega-cap tech stocks, with Amazon up around 10%, Alphabet and Apple gaining about 12%, and Tesla soaring over 60% since Nov. 5.

In this environment, few seem interested in value, as the S&P 500 Value Index slumped 2.67% in the fourth quarter while large-cap growth stocks gained 6.17%.

Therein lies the opportunity for long-term, contrarian investors like us.

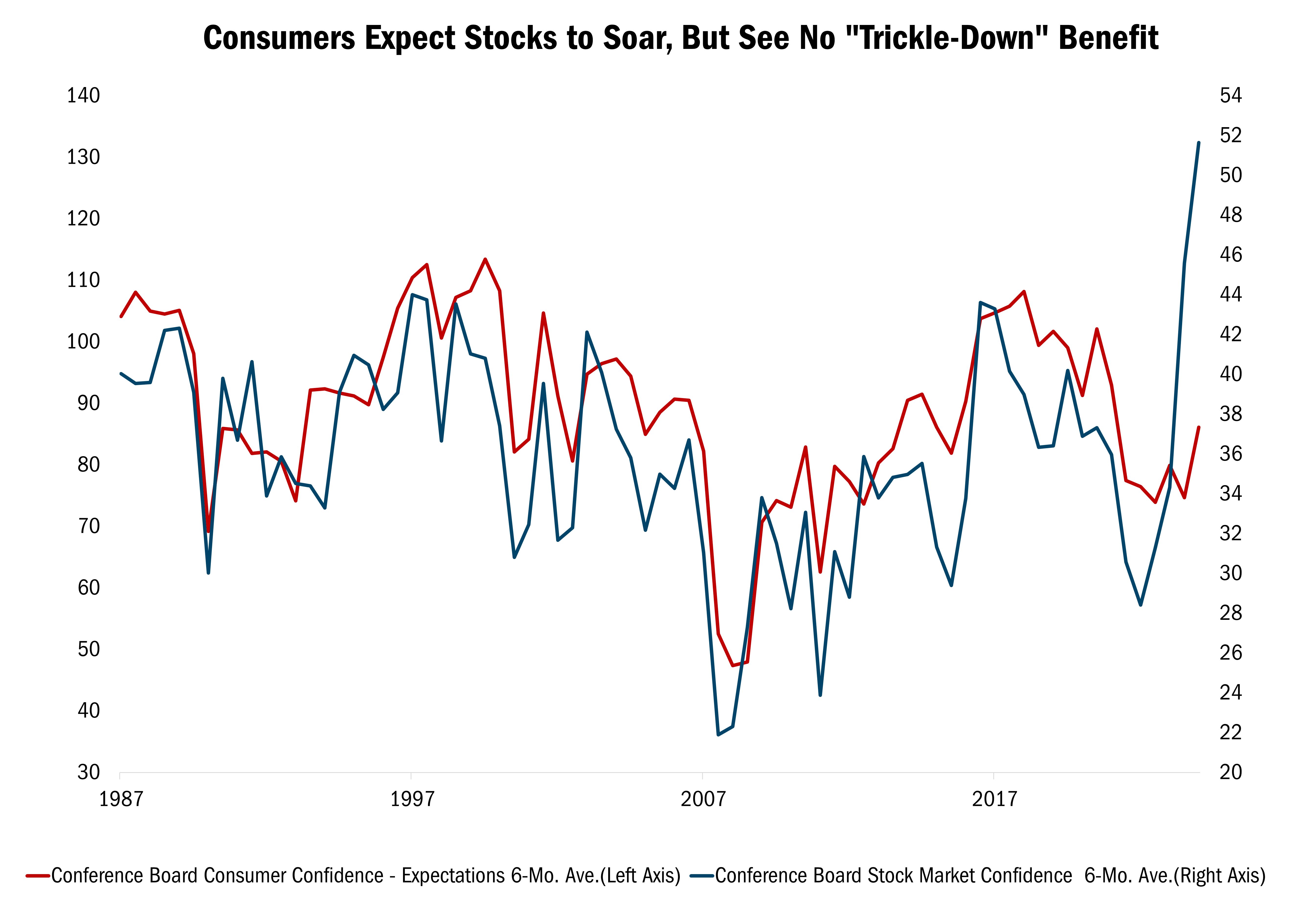

By almost every measure, large-cap glamours are over-valued, over-owned, and have overly lofty expectations. More than a quarter of U.S. companies, based on market capitalization, are trading at more than 10X enterprise value to sales, a level not seen since the dotcom bubble. Investor confidence shot up even higher than it was prior to the tech wreck in 2000. Historically, optimism that stock prices will rise over the next 12 months has largely mirrored consumer sentiment levels.

Lately however, the trends have diverged wildly (see the chart below).

Source: The Leuthold Group and The Conference Board, semiannual data from 12/31/1987 to 12/31/2024. This chart represents the comparison of the Conference Board Consumer Confidence expectations to the Conference Board Stock Market Confidence. CEO Confidence Survey (Conference Board) is a monthly survey of 100 CEOs from a variety of industries in the U.S. economy. The survey is conducted, analyzed, and reported by the Conference Board, and it seeks to gauge the economic outlook of CEOs, determining their concerns for their businesses, and their view on where the economy is headed. A reading above 50 indicates that the CEOs surveyed are more bullish than bearish on their economic outlook. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

We believe active management can capitalize on such marketplace discrepancies. As the economist John Maynard Keynes famously pointed out, successful investing isn’t about noticing what others are thinking now. It’s understanding where their heads will be in the future.

Our version of this strategy is to look for pockets of opportunities in lagging areas that have historically had a strong correlation to what is currently working. One interesting area of disconnect is the Materials sector. Normally, this group moves in the same direction as Industrials, as they supply the inputs used in manufacturing. In our portfolio, Materials stocks were down 16.13% in the quarter even as our Industrials rose 8.83%.

Investors seem to be chasing momentum in Industrials, as evidenced by passive flows into sector ETFs, while showing little interest in packaging stocks, a subsector of materials. Throughout the year, we have been paying particularly close attention to possible opportunities within packaging in anticipation of renewed interest.

One leading producer, Sealed Air Corporation (SEE), a global packager, caught our attention. After thorough research, we determined SEE was mispriced by Wall Street, selling substantially below its intrinsic worth and less than half the market’s price/earnings ratio.

Years ago, the same dynamic played out when WestRock, another packager, lagged badly. However, a strategic buyer took notice and acquired the company at a significant premium to the public market price.

Recently, we have seen similar activity by private equity firms acquiring public companies. The vast majority are outside the pricey growth arena. Smart money seems to be interested in businesses in overlooked areas that are priced reasonably to their cash flow and earnings.

Similarly, we continue to look beyond the herd, guided by our 10 Principles of Value Investing™, which focuses on attractively priced, well-managed businesses that can grow throughout market cycles.

Attribution Analysis & Portfolio Activity

For the quarter, the Heartland Small Cap Value Strategy was up 6.93%, while the Russell 2000® Value Index fell 1.06%. We outperformed the benchmark not just during the last three months but also over past 1, 3, and 5 years.

Stock selection explained virtually all of our outperformance in the fourth quarter, as has been the case over the past 1, 3, and 5 years. Our selection effect was particularly strong in the Consumer Discretionary, Energy, and Health Care sectors, though we underperformed in Technology, Real Estate, and Materials.

We believe our process, which focuses not just on upside potential but also on downside risks, provides us with a strategic advantage. By establishing four price targets for each holding, we are able to consider how investors might value each company under different economic and market scenarios. This gives us a framework for assessing stocks should circumstances change.

In some cases, those four price targets have helped us remain patient, even under challenging circumstances. Take Delek US Holdings, Inc. (DK), an energy company whose refineries produce petroleum products for the transportation industry.

Since April, the stock has been cut nearly in half, amid weakening diesel demand and tighter refining margins. However, there are signs of a recovery for trucking on the horizon, which could start to materialize in the spring or summer of 2025. Barring any shock to the economy, this should provide a boost to refiners.

In the meantime, management is creating its own tailwind, as it is focusing on unlocking the sum of the parts of the combined company. The company recently announced the sale of its 249 gas stations and convenience stores, the proceeds to be used toward a $400 million share repurchase program.

Despite these efforts, we still believe the sum of the parts of Delek is worth substantially more than the current share price of $17. Based on its refining operations, convenience stores, stake in Delek Logistics Partners LP, and other assets, we believe DK is worth $31 a share. The CEO seems to agree that the stock is substantially undervalued, as he has recently been using his personal funds to purchase DK shares.

Admittedly, we were too early in initiating a position in DK at the start of this year. When we moved the company from our watchlist to the portfolio, we set a max downside loss price target of $16 a share. While disappointed in the stocks slide to $17, it was an extreme valuation level that we anticipated might occur.

In our view, the sum-of-the-parts thesis should punch through this overhang and lower oil prices, which serves as a feedstock for the industry and could provide a relative safety net. Whenever the price of West Texas Intermediate (WTI) has gone negative on a year-over-year basis over the past 30 years, as it did earlier this year, shares of refiners have outpaced the energy sector 75% of the time, with an average relative outperformance of 25%.

We are also encouraged by strong insider buying not just at Delek but at several other refiners. An equally hopeful sign: Sophisticated buyers like Carlos Slim and Carl Icahn have also been increasing their exposure to this space lately.

Often, our patience is what drives our selection effect and leads us to certain businesses, like a company that is a supply and equipment distributor for dental practices as well as for veterinary clinics. Investors have been assigning little value to the animal health portion of the business. While that segment isn’t as profitable as the company’s dental unit, it still generates over $4 billion in sales. The company’s remaining sales are in dental distribution. Based on enterprise value to sales, however, the company trades at roughly half of a competitor’s valuation. While some of this discount may be warranted because its animal health segment is less profitable than its dental operations, the company’s dental profitability matches that of competitors.

In our view, shares of this company were grossly undervalued, so we held on even as the stock lost more than a quarter of its value from January through the end of November. We were ultimately rewarded when the company was acquired in mid-December by a private equity health investment firm for $31.35 a share, representing a 36% premium.

A poor performer during the quarter was a recent addition, Dentsply Sirona (XRAY). Shares of the leading manufacturer of dental equipment and supplies lost more than a quarter of their value after the company voluntarily suspended sales of its Byte Aligners and Impression Kits in late October as it conducts a review of regulatory requirements related to the product.

We did not anticipate this development, but understood this type of repricing was possible, having set our max downside target for the stock at $17, just below the current price of around $18 a share. Instead of panicking, we’ve been adding to our position.

In light of recent events, we don’t believe Dentsply will be able to meet our 2026 targets. However, this does not change our confidence in new management’s efforts to improve the company’s financial and competitive standing. The market seems to be overlooking XRAY’s self-help strategy, which includes streamlining its product lines, improving R&D productivity, and accelerating new launches.

The company is well underway on a cost-savings program of roughly $300 million through workforce reductions, manufacturing facility consolidation, and the divestiture of less profitable businesses. Yet the stock seems to be extremely discounted in both absolute and relative terms, trading at just 10.5X next 12-month earnings and 9X EV/EBITDA.

Outlook

In a market priced for perfection, we believe it is prudent to rigorously assess upside potential and downside risks. But that’s not what most investors are doing today — speculation is rampant. Momentum is in. Valuation is not. This could be a replay of the early 2000s, when small and midcaps led the way after years of concentrated bets on shiny ‘New Era’ darlings.

As active managers, we are laser-focused on undervalued companies that adhere to our 10 Principles of Value Investing™. At the very least, companies with earnings yields approaching 8% or more — based on their low price/earnings ratios — should receive increased attention in the year(s) ahead.

In 40 years of managing private accounts, now more than ever, it’s our responsibility to anticipate those shifts and position your assets prudently to take advantage of favorable risk vs. reward opportunities.

Fundamentally yours,

The Heartland Investment Team