Throughout the year, we have been looking for ‘green shoots’ in the market. We are focused on companies with strong capital allocation policies and stabilizing sales that we think could enjoy an uptick in earnings once demand dynamics improve, self-help strategies gain traction, and the market broadens out.

On that front, investors received some hopeful news late in the quarter when the Federal Reserve began to cut short-term interest rates for the first time since the global pandemic. Optimism in anticipation of an easing cycle helped lift the Russell 2000® Index of small stocks up 9.27% in the third quarter, versus the 5.89% gains for the S&P 500 Index.

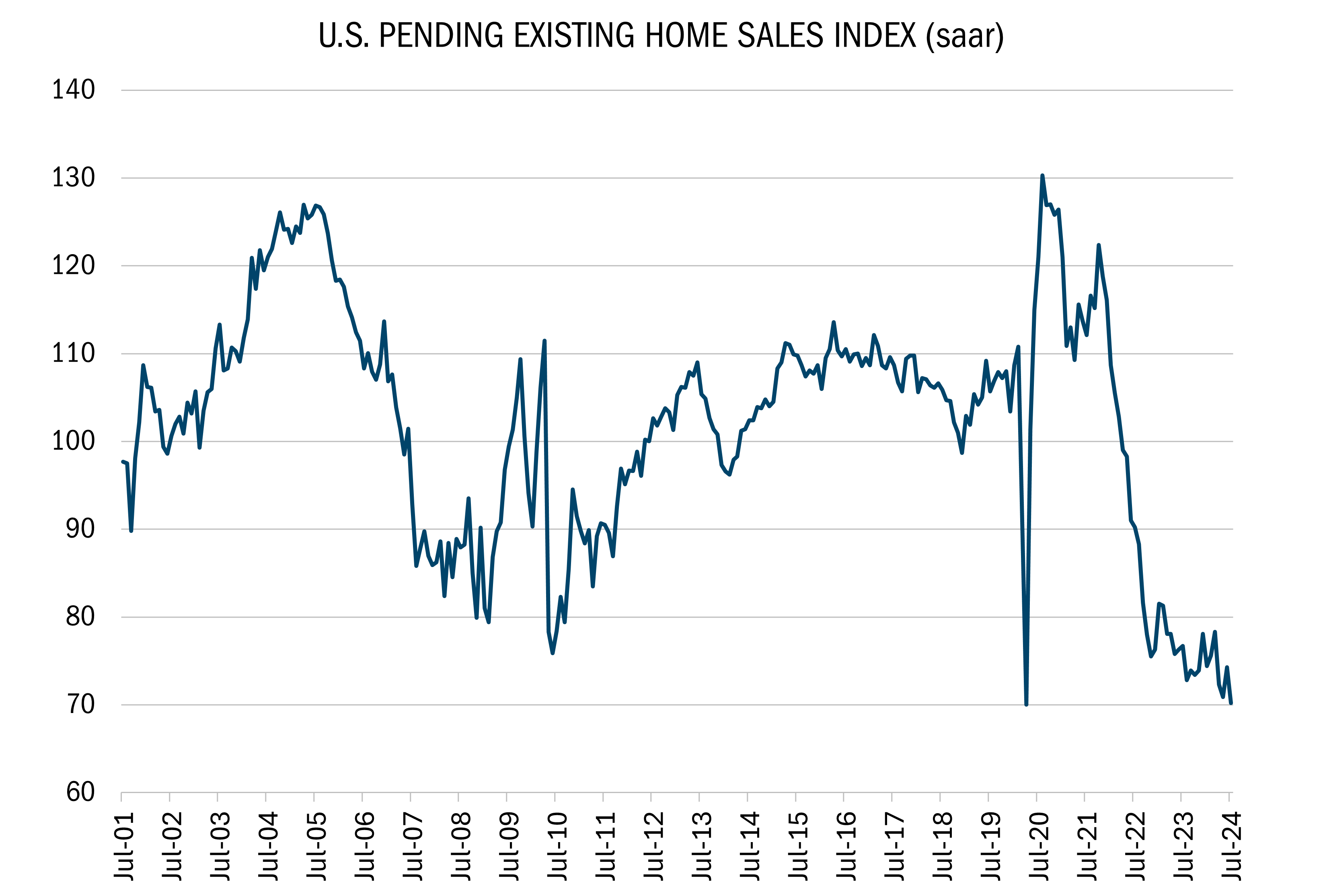

Rate cuts could eventually lead to a modest demand push, augmenting the existing green shoots we are focusing on – especially for companies tied to housing. As the chart below shows, the National Association of Realtors’ Pending Existing Home Sales Index is at its lowest levels since the pandemic, foreshadowing a potential rebound now that rates are falling, especially if the Federal Reserve has managed to pull off a soft landing.

Source: Furey Research Partners, FactSet Research Systems, Inc., and US National Association of Realtors. Monthly data 7/31/01 to 7/31/24. This chart represents US pending existing home sales based upon contracts signed but not closed. All indices are unmanaged. It is not possible to invest in an index. Past performance does not guarantee future results.

While it would certainly be a positive sign if lower borrowing costs were to spark an uptick in demand, we know we can’t bank on it. We take solace in the fact that companies that are actively taking steps to improve their financial strength, competitive advantage, and operational efficiency are being rewarded in this market. By contrast, companies simply waiting around for sales to improve remain under pressure.

Attribution Analysis & Portfolio Activity

In the third quarter, the Value Plus Strategy gained 7.93%, trailing the Russell 2000® Value Index, which returned 10.15%. Stock selection, particularly in the Health Care, Information Technology, and Energy sectors, contributed to the underperformance. However, selection effect helped the Strategy outperform the benchmark in Consumer Discretionary, Industrials, and Financials.

We initiated positions in several new holdings while exiting or reducing our exposure in a handful of others. In some cases, we replaced an existing holding with an industry peer that we consider an upgrade.

A good example is Gates Industrial Corporation (GTES). This leading manufacturer of belts and hoses for vehicles and industrial machines trades at a more compelling valuation with a better self-help story than Astec Industries, an industrial manufacturer we exited during the quarter.

Over 60% of Gates’ revenues come from regular replacement of mission-critical products, providing stability through the business cycle and pricing power. At the same time, 83% of its sales are generated in markets where the company is among the Top 3 players. As a result, GTES enjoys gross margins in the top quartile of machinery stocks in the Russell 3000® Index.

Beginning in 2021, the stock came under pressure when Blackstone, which had owned 84% of the stock, began to sell, eventually lowering its stake down to 8%. This created an overhang for the stock while compressing valuations relative to its industrial peers. But recently, this company has embarked on a series of self-help strategies that have reduced material costs, consolidated factories, and focused its efforts on the most profitable segments of its business. This has already led to an improvement of EBITDA margins to 23.5-25.5%, up from 20.9% in 2023, despite a decline in sales. We believe GTES has more margin improvement to come from self-help and an eventual improvement in the manufacturing economy.

GTES shares trade at 8.4X next year’s EBITDA, which is below the multiple for other industrial companies with similar business quality and margin profiles. We don’t believe this discount is warranted. Meanwhile, the stock seems to have significant upside potential as earnings continue to improve through self-help and an improved economy.

During the quarter, we increased our weighting to another industrial company, Hayward Holdings (HAYW), which makes pool components such as pumps, filters, heaters and cleaners. The company is the second largest player in a trio that controls roughly 90% of the residential pool market in North America. Hayward makes products that are critical for owning a pool but represent a low percentage of the total cost of ownership. This results in pricing power that feeds profitability. HAYW’s gross margins place it in the top 10% of the Russell 3000® Index building products category.

New pool construction has been on a roller coaster ride lately. After peaking during the pandemic, construction activity has taken a plunge thanks to rising interest rates and fluctuating housing starts. HAYW’s revenues, though, seem to be more resilient because half of the company’s sales come from the replacement of components in existing pools, which tends to be steady throughout an entire cycle. Additionally, pool construction has historically lagged new home construction by around one to three years, and single-family home starts have stabilized after slumping from 2022 to early 2023. Meanwhile, Hayward has implemented self-help strategies that include consolidating manufacturing facilities and implementing Kaizen manufacturing principles, which have improved gross margins by nearly 300 basis points. When pool construction and remodeling pick back up, we believe HAYW will earn significantly more due to its improved gross margin profile and operating leverage as capacity utilization improves.

Outlook

While the Federal Reserve’s accommodative stance raises hope for an improvement in demand dynamics, it’s important to understand this may not unfold immediately. This is why, regardless of the change in monetary policy, our ultimate goal remains the same: to patiently identify management teams with strong capital allocation policies as a foundation for delivering shareholder returns, guided by our 10 Principles of Value Investing™. We are also confident that companies that are taking steps to improve their competitive and operational standing regardless of economic conditions will be rewarded — especially as green shoots emerge to complement “self-help” operational improvements.