In the aftermath of the election, investors began gravitating toward parts of the market deemed to be the winners of President-elect Trump’s agenda, which included tech stocks and cryptocurrencies that stand to benefit from less regulation. We’ve chosen to keep our focus on a different group of companies. In the fourth quarter, we continued our year-long search for ‘green shoots’ — companies across industries showing strong signs of earnings growth improvement that stand to benefit once demand dynamics begin to improve.

This remains a relatively small universe, but the net seems to be widening. Should fiscal stimulus in the form of deregulation and tax cuts materialize, demand dynamics could positively impact these green shoots along with the sectors of the market that have been rallying since the election.

It should be noted that against this backdrop of market exuberance, many companies have been quietly working behind the scenes to improve their operational efficiencies, strategic positioning, and competitive standing and are now beginning to enjoy the fruits of those efforts. Companies that are employing such ‘self-help’ strategies are precisely the types of companies we covet — so long as they also adhere to our 10 Principles of Value Investing™, which focus on attractively priced, well-managed companies with high-quality balance sheets and positive earnings dynamics.

In the post-election rally, the market has broadened out beyond the mega caps that have dominated in recent years. However, it’s been the low-quality segment of the small-cap market that has initially benefited. We think small caps can continue to rebound and the market could broaden further to include higher-quality companies.

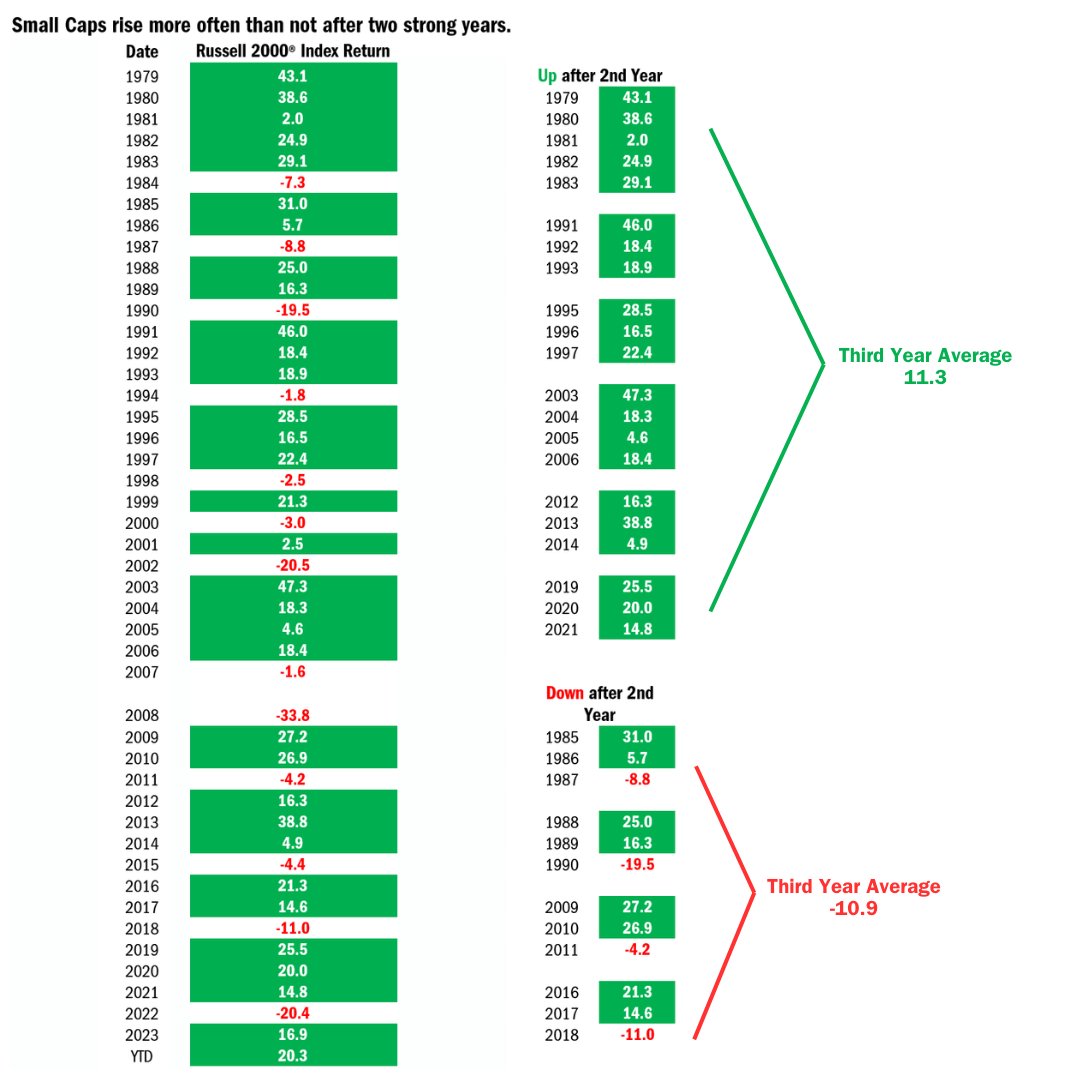

Part of that is rooted in history. Despite all the recent focus on the Magnificent 7 Tech Giants, small stocks have actually posted two consecutive strong years. In 2024, the Russell 2000® Index returned 11.54% after posting 16.93% gains the prior year. There have been 10 instances where the Russell 2000® has posted two consecutive years of positive gains, and in six of those cases, small caps rose in the third year, averaging 11.3% returns (see the chart below).

Source: Furey Research Partners and FactSet, annual data as of 12/31/1979 through YTD as of 12/6/2024. This chart shows U.S. small-cap index maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group. Russell 2000® Index includes the 2000 firms from the Russell 3000® Index with the smallest market capitalizations. All indices are unmanaged. It is not possible to invest directly in an index. Past performance does not guarantee future results.

There are no guarantees that 2025 will be positive, but we’re at least confident in the potential for the subset of small caps we’re focusing on: Well-managed small companies trading at attractive prices with strong balances sheets and self-help strategies to position themselves to thrive once demand begins to pick up within the economy.

Attribution Analysis & Portfolio Activity

The Value Plus Fund was down 1.79% in the fourth quarter, compared with the 1.06% loss for the Russell 2000® Value Index. While stock selection was modestly negative across the entire portfolio, the selection effect was particularly strong in the Financials sector, which produced five of the biggest contributors to the Strategy’s performance during the quarter.

Our Strategy’s exposure to the Financials sector is generally in-line with that of the benchmark. But we have focused on a few key attributes. For instance, we have been concentrating on banks with relatively cheap valuations operating in geographical areas that are showing strong signs of growth. We have also favored companies where insider buying activity and dividend growth have been strong.

Overall, we initiated positions in a few new names during the quarter while adding to our exposure in some existing holdings. In some cases, we did so while replacing or reducing exposure to an industry peer in an effort to upgrade the portfolio. Here are some examples of our recent moves, which illustrate our overall approach:

Financials. FB Financial (FBK) was one our Strategy’s best-performing holdings in the fourth quarter and 2024. Shares of the Nashville company, which provides commercial and consumer banking services in the Southeast through its subsidiary FirstBank, rose more than 29% for the full year on strong deposit and loan growth across its portfolio.

FBK, which operates in Tennessee, Kentucky, North Georgia, and Alabama, is a prime example of what we have been looking for lately in the Financials sector: attractively priced banks operating in attractive regions. In August, the company restructured its securities portfolio, which should boost interest income and net interest income going forward. Insiders continue to buy the stock, suggesting their confidence in the outlook for the company.

What gives us confidence is that despite the strong run, FBK is still trading at just 1.8X tangible book value, which is below its 10-year average. Based on earnings, the stock sports a modest 15X multiple despite its stable net income margin and growing dividend yield.

Technology. Semtech Corporation (SMTC), which manufactures optical components and technology solutions used in data centers and IoT (Internet of Things) systems, is a position we initiated in the third quarter and increased our exposure to in the fourth.

Semtech, one of our Strategy’s best performers in the past quarter, is an example of a stock we’ve owned in the past and recently returned to as circumstances improved. We last held SMTC a few years ago, before it announced its acquisition of Sierra Wireless. The company levered up in late 2022 to make the purchase. Soon after the deal was completed, the stock sold off and the existing management team was replaced. The new management team is now seeking to divest some of Sierra Wireless’ assets to de-lever and regain focus on Semtech’s core business.

We’ve kept the company on our radar since the acquisition. Semtech’s signal integrity business, the company’s crown jewel franchise, is a backbone component of many data centers. With growing demand for data centers in the AI boom, we believe this could be a real opportunity for the company. New management has been clear they intend to divest non-core business lines to reduce leverage, which should unlock additional value. Yet the stock currently trades at a 20-25% discount to its peers based on EBITDA.

Outlook

The broadening of the market that we witnessed in the fourth quarter is certainly a hopeful sign. And we believe higher quality small stocks will eventually participate in the rally as smaller companies benefit from easing monetary policy and fiscal stimulus. However, we can’t say for certain if that will come to pass — or when. That’s why we’ve been focusing our attention on companies that are helping themselves through strategies that improve their financial strength and competitive standing. These ‘green shoots’ would certainly benefit from accelerating demand if policy prescriptions take hold, but they aren’t dependent on it. As fundamentally driven investors, that’s our job: staying true to our 10 Principles of Value Investing™ by finding attractively priced, well-managed businesses that can grow intrinsic value over time.

Thank you for your continued trust and confidence in us.